Peloton’s (PTON) stock has been on a rollercoaster ride. Despite a fall of 85% over the past three years, it recently made a remarkable recovery, rising from the ashes and surging 171.58% in the past 90 days. This is due primarily to the company’s successful efforts in reducing losses and stabilizing revenue. The anticipation around the arrival of the new CEO, Peter Stern, an ex-Apple heavyweight, brings further optimism. The company posted impressive top-and-bottom-line beats for the most recent quarter and looks to keep the momentum going, announcing its first seasonal retail collaboration with Costco (COST), with the Peloton Bike+ being sold in Costco’s 300 U.S. stores and online.

Analysts have upgraded their ratings and price targets for the company, citing confidence in the new CEO, a stronger focus on profitability, and substantial earnings upside. This is potentially an intriguing inflection point for investors interested in a turnaround opportunity.

Peloton Showing Signs of a Turnaround

Peloton Interactive is a global fitness platform that produces and sells fitness products. Its product range includes the Peloton Bike, Bike+, Tread, Tread+, Guide, and Row.

Currently, the company is engaged in aggressive cost-cutting measures after CEO Barry McCarthy stepped down and was replaced by interim co-CEOs Karen Boone and Chris Bruzzo. The newly announced CEO, Peter Stern, former President of Ford Integrated Services (F) and an executive at Apple (AAPL) and Time Warner Cable, will inherit a company showing signs of a turnaround. Stern has worked extensively on subscription-based businesses and has experience with innovating technology-oriented platforms.

Peloton Interactive and Costco have recently announced a partnership in which Costco will sell the Peloton Bike+ in 300 U.S. stores and online during the upcoming holiday season. This partnership represents Peloton’s first seasonal retail collaboration in the U.S., with a company renowned for offering high-quality, branded merchandise to its 136 million members.

Peloton’s Recent Financial Results

The company recently announced results for Q1 FY25. Revenue of $586 million surpassed analysts’ expectations by $14.3 million. The increase was driven by higher paid connected fitness and paid app subscriptions. The company ended the quarter with 2.90 million ending paid Connected Fitness Subscriptions and 582 thousand ending Paid App Subscriptions, exceeding its guidance range by 10 thousand and 12 thousand subscribers, respectively, primarily due to favorable net churn.

The total gross profit was $303.8 million, resulting in a total gross margin of 51.8%, which was 1.8% higher than projected, primarily because of favorable revenue mix-shifts and Connected Fitness Products’ gross margin. Operating expenses fell by 30.3% to $291.2 million compared to the same period in the previous year due to cuts in personnel-related expenses and decreases in professional services fees and ad spending.

Adjusted EBITDA was $115.8 million, marking a year-over-year improvement of $106.7 million. Net cash generated by operating activities stood at $12.5 million, and free cash flow was $10.7 million. GAAP earnings per share (EPS) of $0.00 exceeded consensus expectations by $0.15.

The firm finished the quarter with $722.3 million in unrestricted cash and cash equivalents, and it has yet to tap into its $100.0 million revolving credit facility.

In the aftermath of its third-quarter earnings report, PTON’s management has issued guidance for Q2 FY25, with revenue projected at $640M-$660M. However, a sequential decline in total gross margin is expected due to a seasonal mix-shift towards Connected Fitness Products during the holiday sales period. Adjusted EBITDA will decline due to higher sales and marketing expenses during the holiday season.

What Is the Price Target for PTON Stock?

After a significant downturn from its COVID-era highs, the stock has clawed its way back to a positive trajectory, climbing 25% year-to-date. It trades at the higher end of its 52-week price range of $2.70 – $8.92. Despite the share price jump, it trades at a relative discount with a P/S ratio of 1.1x compared to the Leisure industry average of 1.8x.

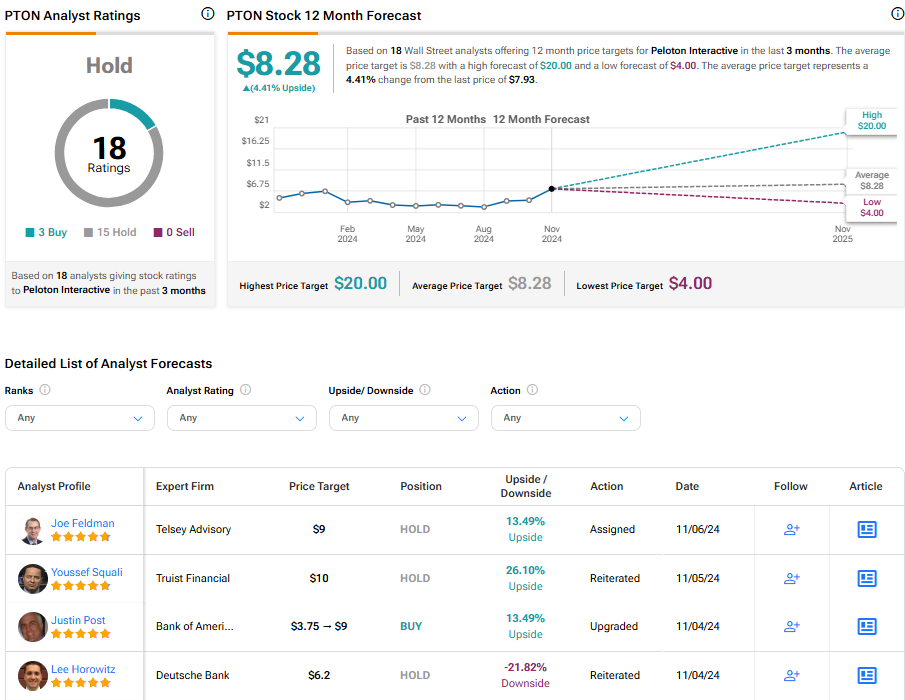

Analysts following the company have been cautiously optimistic about PTON stock. For instance, Bank of America analyst Curtis Nagle recently upgraded the stock to a Buy rating, tripling the price target from $3.75 to $9, citing the fitness company’s recent earnings beat, the new CEO, and the potential for significant earnings upside.

Based on 18 analysts’ recommendations, Peloton Interactive is rated a Hold overall. The average price target is $8.28, representing a potential upside of 4.41% from current levels.

Peloton in Summary

Peloton has shown remarkable resilience and potential for a turnaround after a steep fall over the past three years. Driven by aggressive cost management and solid earnings performance, the company has seen a surge in its stock. The appointment of a new CEO – a seasoned leader with an impressive track record in subscription-based businesses and technology – instills further optimism. Despite a promising recovery, PTON shares still trade at a relatively attractive valuation, providing an intriguing opportunity for investors based on the company’s potential for further earnings upside.