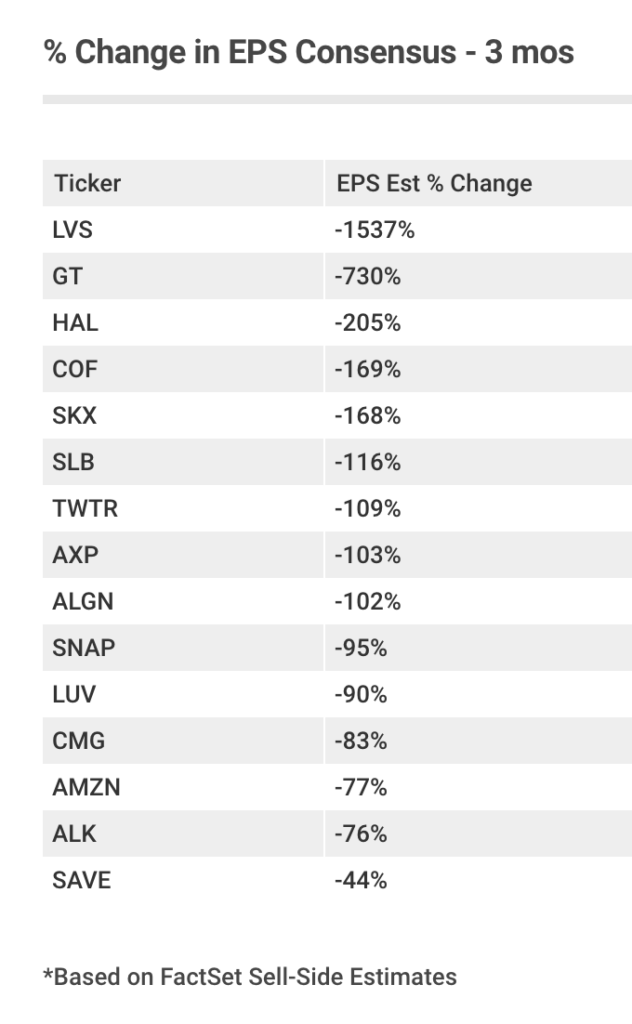

This week marks the beginning of peak earnings season, and below are the names reporting this week that have seen the largest downtick in estimates over the last 3 months.

Other Names We’re Watching this Week:

Airlines – UAL, AAL, ALK, LUV

The remaining 4 airlines in the S&P 500 all report this week: United Airlines (UAL), Southwest (LUV), American Airlines (AAL) and Alaska Airlines (ALK). Expect them all to follow in the footsteps of Delta’s terrible report last week; the airline missed the bottom-line by $0.27 (a YoY decline of 289%) and PRASM fell 60% YoY. All three major international carriers, UAL, DAL and AAL have announced layoffs that would number in the tens of thousands, only the union representing UALs pilots was able to reach an agreement to reduce these numbers. Many airline CEOs have also made clear that the industry won’t be returning to full capacity for at least 2 years.

Something else all of these names have in common is the fact that they are all on the top 30 list of S&P 500 companies with the largest estimates dispersion leading into Q2 reports. UAL is number 2 on that list, with a dispersion between the lowest sell-side estimate and the highest estimate of $14.42. AAL is fourth on the list with $9.39. ALK ranks number 19 with $3.98. And LUV is #30 with $2.45.

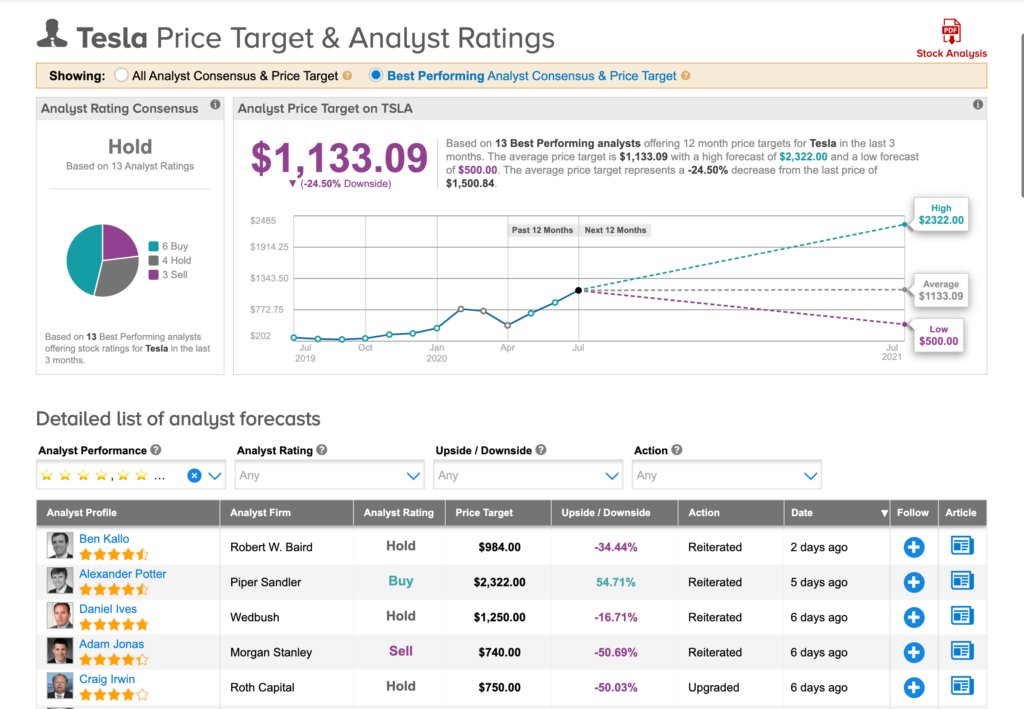

Tesla (TSLA)

- Reports July 22, after the bell

- Expected Earnings Growth: 88%

- Expected Rev Growth: -19%

- Consensus Price Target: $1,133.09 (24.50% downside)

- Consensus Rating: Hold (13 best performing analysts: 6 buy, 4 hold, 3 sell)

The ever controversial Tesla, investors seem to either love or hate this company. Analysts seem split as well. On the one hand, the soaring stock price seems to fly in the face of recent auto trends, with Q2 auto sales in the US dropping 33%. On the other hand, the Model 3 has been performing incredibly well in the US, China and certain European markets.

Tesla’s stock has been on fire recently, mainly as a result of model 3 sales, likely inclusion in the S&P 500, as well as an influx of interest amongst retail investors. Alexander Potter, the 4.5 star analyst from Piper Sandler recently increased his PT to $2233, up 54.7% from where TSLA currently trades.

But one thing Tesla followers know well is that the company tends to over promise and then under-deliver on earnings day, although in 2019 deliveries did hit the low end of their 360-400k guidance at 367,637, after a rough start to the year. This year the company set out to deliver 500k vehicles. This guidance was not revised or discussed at all in the Q1 call, leading many investors to worry that given shutdowns at the Fremont factory and the Giga Shanghai in the first half of the year could impact these deliveries.

Tesla seems to be doing a lot of good things right now, but at current prices, any small piece of negative commentary on Wednesday could send the stock down.

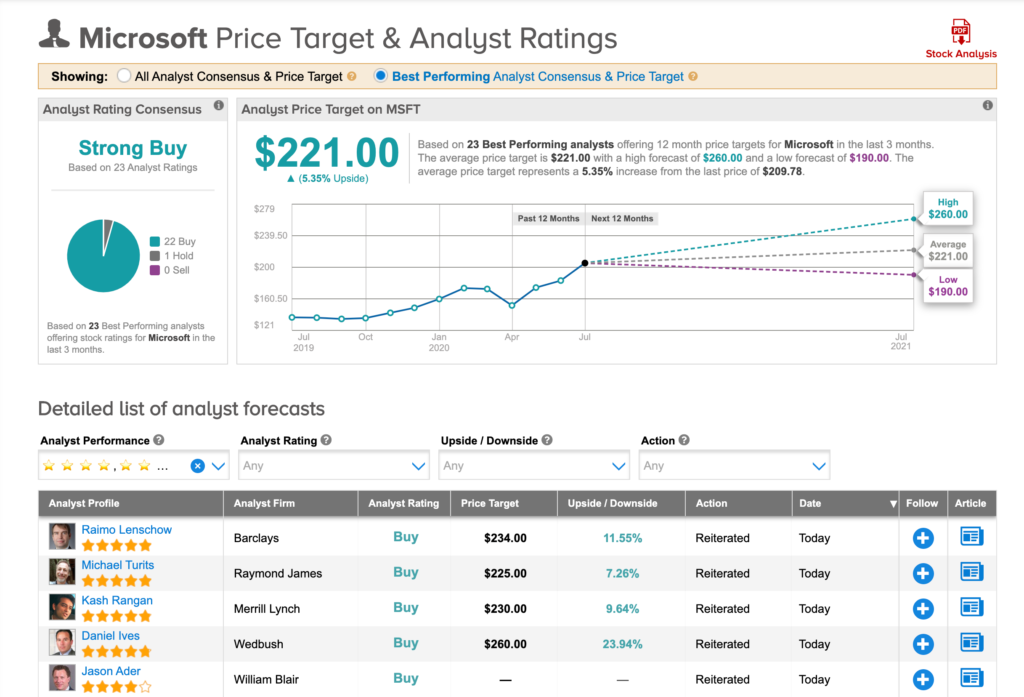

Microsoft (MSFT)

- Reports July 22, after the bell

- Expected Earnings Growth: 0%

- Expected Rev Growth: 8%

- Consensus Price Target: $221 (5% upside)

- Consensus Rating: Strong Buy (23 top analysts: 22 buys, 1 hold)

Microsoft is likely to see another quarter of gains due to more people working remotely. Analysts are expecting increased adoption of their cloud computing service, Azure, which MSFT has continued to improve as competition with AWS heats up.

The company is also enhancing features on Teams, such as improved video conferencing and file sharing to compete with other work from home favorites like Zoom and Slack.

Microsoft saw its stock hit a record high of $214.32 two weeks ago.

Twitter (TWTR)

- Reports July 23, after the bell

- Expected Earnings Growth: -105%

- Expected Rev Growth: -17%

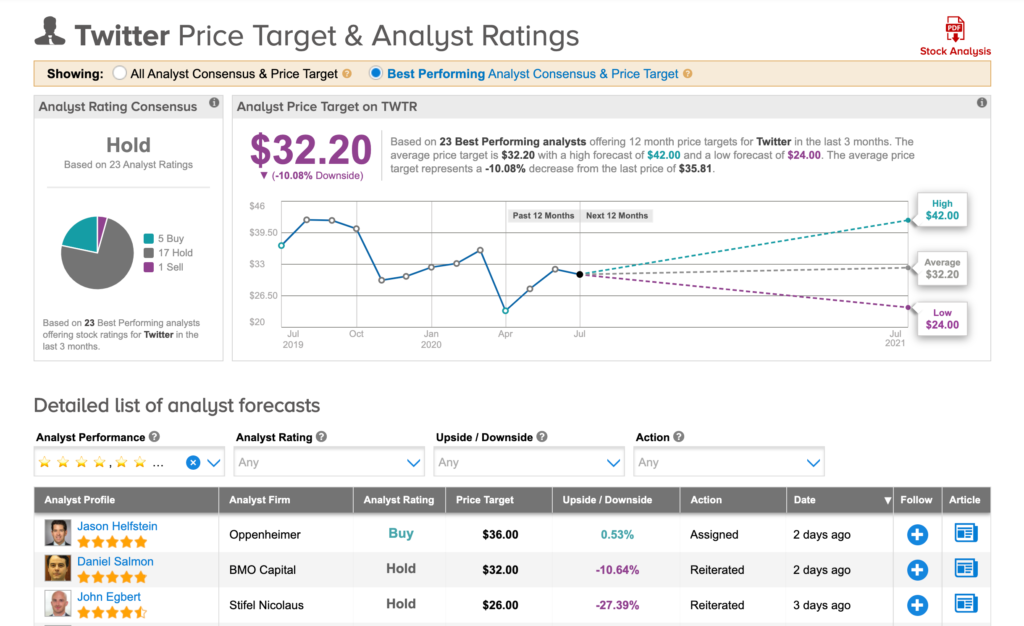

- Consensus Price Target: $32.20 (10% downside)

- Consensus Rating: Hold (23 top analysts: 5 buy, 17 hold, 1 sell)

Twitter’s recent hack has raised some major concerns around its data security, sending its stock down nearly 5% in its wake, only to recover by the end of last week. Expectations on the bottom-line have fallen 109% since last quarter’s report, and the top-line has fallen 10%. Despite the desire to reduce spending this year, the company will now have to increase spending around security to ensure this doesn’t happen again. The hack will also impact user growth and engagement which means lower ad revs.

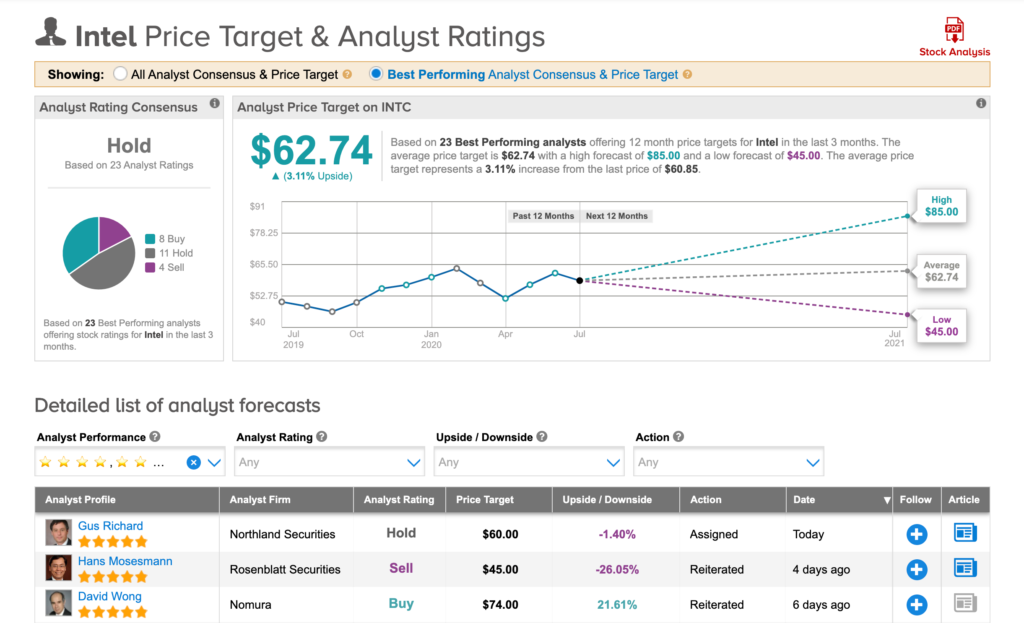

Intel (INTC)

- Reports July 23, after the bell

- Expected Earnings Growth: 5%

- Expected Rev Growth: 12%

- Consensus Price Target: $62.74 (5% upside)

- Consensus Rating: Hold (23 top analysts: 8 buy, 11 hold, 4 sell)

Another beneficiary of stay-at-home, Intel’s data center business and higher adoption rates of it’s cloud-based solutions could mean good things are in store for it’s Q2 report. An increase in PC sales and processors are also expected to be bright spots.

One downside for INTC in the coming quarters is the fact that it’s chips will no longer be used in upcoming versions of Mac computers, something that’s been speculated for years. While Apple’s own chips have improved over time, Intel’s have seemingly stagnated, where in some cases iPhone chips were reported to outperform chips from Intel’s Core line used in laptops. As a result, earnings and revenues are all currently expected to dip negative for the next 3 quarters.