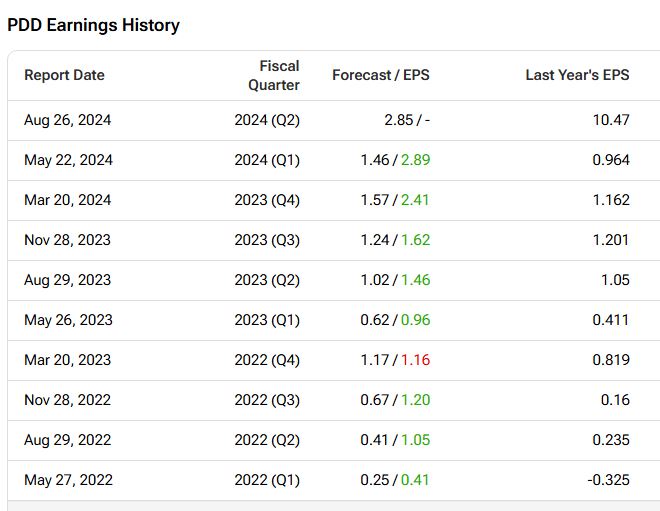

Chinese e-commerce giant PDD Holdings (PDD) will release its Q2 results on August 26. Wall Street analysts expect the company to report earnings of $2.85 per share for Q2 2024, up 95% from the prior-year quarter. Meanwhile, analysts expect revenues of $13.69 billion, reflecting an 84% year-over-year decrease, according to TipRanks’ data.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company is known for its Pinduoduo discount e-commerce platform and its international counterpart, Temu.

In terms of share price growth, PDD Holdings increased 88.9% over the past year and 0.6% year-to-date. It’s interesting to note that the company has maintained a strong record of earnings surprises, surpassing estimates in eight out of the past nine quarters.

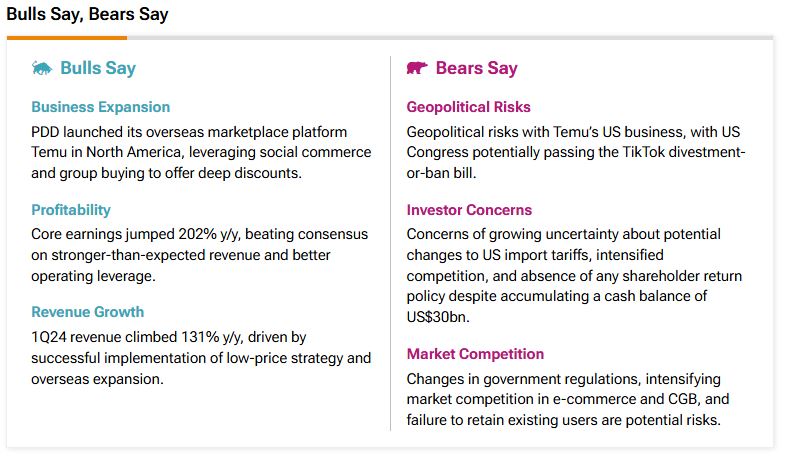

Key Takeaways from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool pictured below, analysts anticipate that PDD’s business expansion will continue to strengthen, particularly with the launch of its Temu platform in North America. They highlight the company’s impressive Q1 results, where core earnings soared 202% year-over-year. Analysts are also encouraged by the revenue growth, driven by PDD’s effective low-price strategy and successful international expansion.

However, bears worry about geopolitical risks, such as potential U.S. legislation affecting Temu and uncertainties around U.S. import tariffs. Concerns also include increasing competition, no shareholder return policy despite a $30 billion cash reserve, and risks from regulatory changes.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 1.73% move in either direction.

Is PDD a Good Stock to Buy?

Overall, the Street has a Strong Buy consensus rating on PDD, alongside an average price target of $218.36. However, analysts’ views on the company could see changes after the company reports its Q2 earnings.