Paychex (NASDAQ:PAYX) shares plunged by nearly 8% in the early session today after the company reported its results for the third quarter. Paychex is a leading provider of human capital management solutions.

PAYX Mixed Performance

During the quarter, revenue increased by 4% year-over-year to $1.44 billion; however, the figure fell short of expectations by $20 million. Its EPS of $1.38, on the other hand, met estimates.

The company’s third-quarter top line was impacted by lower contributions from its Employee Retention Tax Credit (ERTC) service. Excluding this impact, it experienced accelerated top-line growth. Additionally, a focus on streamlining expenses helped Paychex boost its EPS by 7% for the quarter

Paychex Future Expectations

Looking ahead, the company is investing in data, analytics, and AI to enhance solutions for its clients. For Fiscal Year 2024, Paychex anticipates total revenue to grow by 5% to 6%. It also maintains an expectation of a 10% to 11% increase in adjusted EPS for the full year.

Is PAYX a Good Stock to Buy?

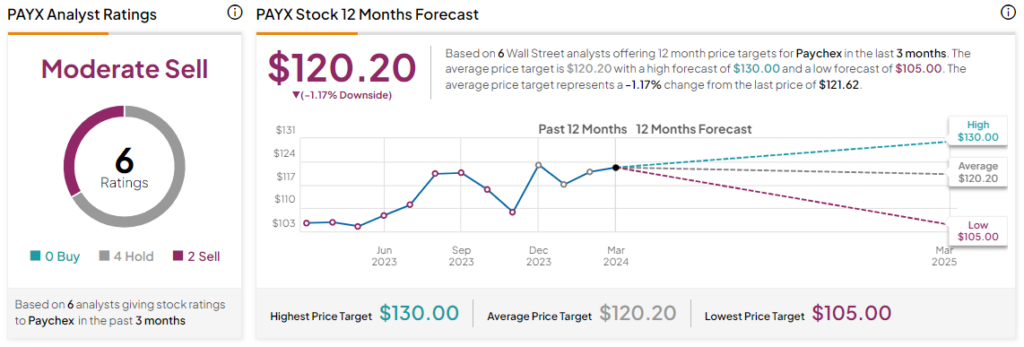

Today’s price decline comes after a nearly 13% rise in Paychex shares over the past year. Overall, the Street has a Moderate Sell consensus rating on the stock alongside an average PAYX price target of $120.20. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure