Shares of the financial services company Paysign (NASDAQ:PAYS) are up more than 61% in one year. The company that provides prepaid card programs, patient affordability offerings, integrated payment processing, and digital banking services benefits from continued growth across all its businesses. Despite the notable increase, analysts love this penny stock (learn more about penny stocks here) and are optimistic about its prospects.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

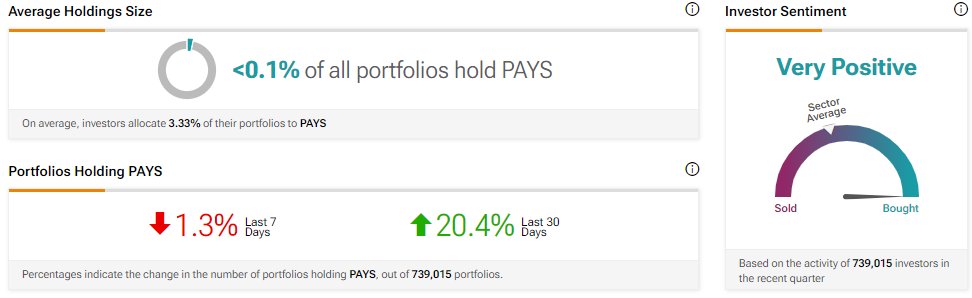

Besides for analysts, individual investors have a Very Positive view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 20.4%. This suggests that investors are optimistic about its growth prospects.

Learn more about TipRanks’ powerful Investor Sentiment tool here.

Paysign’s Strong Start to 2024

Paysign started 2024 on a solid note, reflecting a 30% year-over-year increase in revenue and an impressive 135% jump in adjusted EBITDA. Paysign’s other key performance indicators, including gross dollar load volume and gross spend volume, also improved during the first quarter.

It’s worth noting that the company’s Patient Affordability business continues to grow rapidly and is a key catalyst behind its revenue and earnings. The company’s management highlighted during the Q1 conference call that the Patient Affordability segment’s growth trajectory has accelerated, and the division contributed 59% of its total year-over-year revenue growth.

Given the acceleration in its Patient Affordability business, the momentum in Paysign’s business is likely to be sustained. Echoing similar sentiments, Barrington analyst Gary Prestopino reiterated a Buy on PAYS stock on May 10. The five-star analyst, who has a success rate of 59%, raised the price target to $7 from $5.50, implying 69.49% upside potential from current levels.

Is PAYS Stock a Buy or Sell?

Wall Street is bullish about PAYS stock. Four analysts cover PAYS stock, and all recommend a Buy, which leads to a Strong Buy consensus rating.

These analysts’ average price target on PAYS stock is $6.17, implying an upside potential of 49.39% from current levels.

Bottom Line

Paysign is well-positioned to deliver solid financials in the upcoming quarters, led by momentum in its Patient Affordability business. PAYS stock has gained substantially over the past year. Further, analysts see more upside, as reflected in their average price target.

While analysts love Paysign, investors can leverage TipRanks’ penny stock screener to find more top-rated penny stocks.