PayPal (PYPL) has taken a significant step in digital payments by completing its first business transaction using its proprietary stablecoin, PayPal USD (PYUSD). This move reflects the increasing role of stablecoins in the corporate world.

It is worth noting that PYPL’s inaugural stablecoin payment was executed on September 23 to settle an invoice with accounting giant Ernst & Young. The transaction leveraged SAP SE’s (DE:SAP) digital currency hub, a platform designed to facilitate instant digital payments for enterprises. However, the transaction amount hasn’t been disclosed.

PYUSD Continues to Gain Traction

Launched in August 2023, PYUSD has quickly gained traction. Backed by U.S. dollar deposits and short-term U.S. Treasuries, PYUSD offers stability and security for transactions. Also, its market capitalization has risen to nearly $700 million, securing a position as the eighth-largest stablecoin.

It is worth highlighting that PYUSD was initially issued on the Ethereum (ETH-USD) blockchain, but expanded to the Solana (SOL-USD) network in late May. This led to an increase in PYUSD’s user activity, with monthly active wallet addresses jumping from 9,400 in May to over 25,000 in July.

Moreover, PayPal has been expanding the adoption of its stablecoin, PYUSD, through strategic partnerships. This includes collaborations with Anchorage Digital to provide rewards for holding PYUSD. Additionally, PYPL’s collaboration with Paxos, the blockchain infrastructure firm responsible for managing and issuing PYUSD, has proven fruitful.

Is PYPL a Buy or Sell?

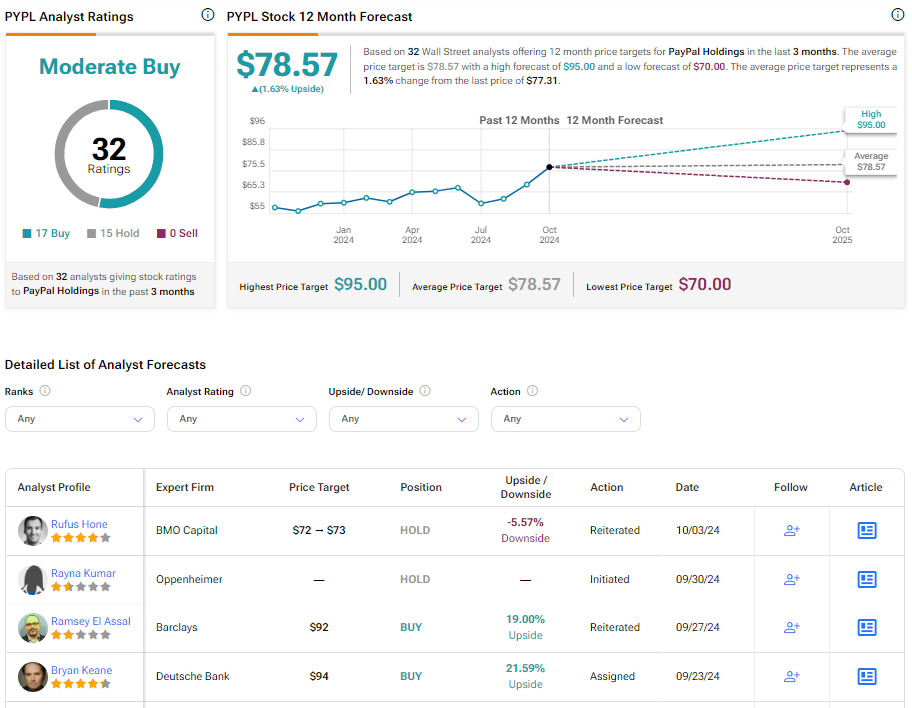

Turning to Wall Street, PYPL stock has a Moderate Buy consensus rating based on 17 Buys and 15 Holds assigned in the last three months. At $78.57, the average PayPal price target implies a 1.63% upside potential. Shares of the company have gained 25.89% year-to-date.