PayPal (PYPL) is a major name in the mobile payments space. In recent years, the company has seen its market share and stock decline. However, CEO Alex Chriss is winning praise for helping to turnaround PayPal’s fortunes during his first year at the company.

Things did not look good for PayPal a year ago. The company faced a host of new competitors and its guidance was on the shaky side. But PYPL stock has been on the rise thanks to some aggressive cost-cutting measures and a marked increase in customer focus and new product offerings.

Analysts expect revenue growth at PayPal to hit around 6% for this year’s third quarter. For the fourth quarter, growth should be around 5.5%. Much of the credit for that growth is going to CEO Alex Chriss.

A Fastlane Win?

A potential catalyst for PayPal is its Fastlane project that enables users to access payment information from an email address, which speeds things up considerably. New partnerships have also provided a boost to PayPal’s fortunes.

Analysts are taking notice. Timothy Chiodo with UBS (UBS) declared that PayPal was likely to get a boost in its share price from improving gross payment volumes thanks to a new deal with Shopify (SHOP).

Is PayPal a Buy, Hold or Sell?

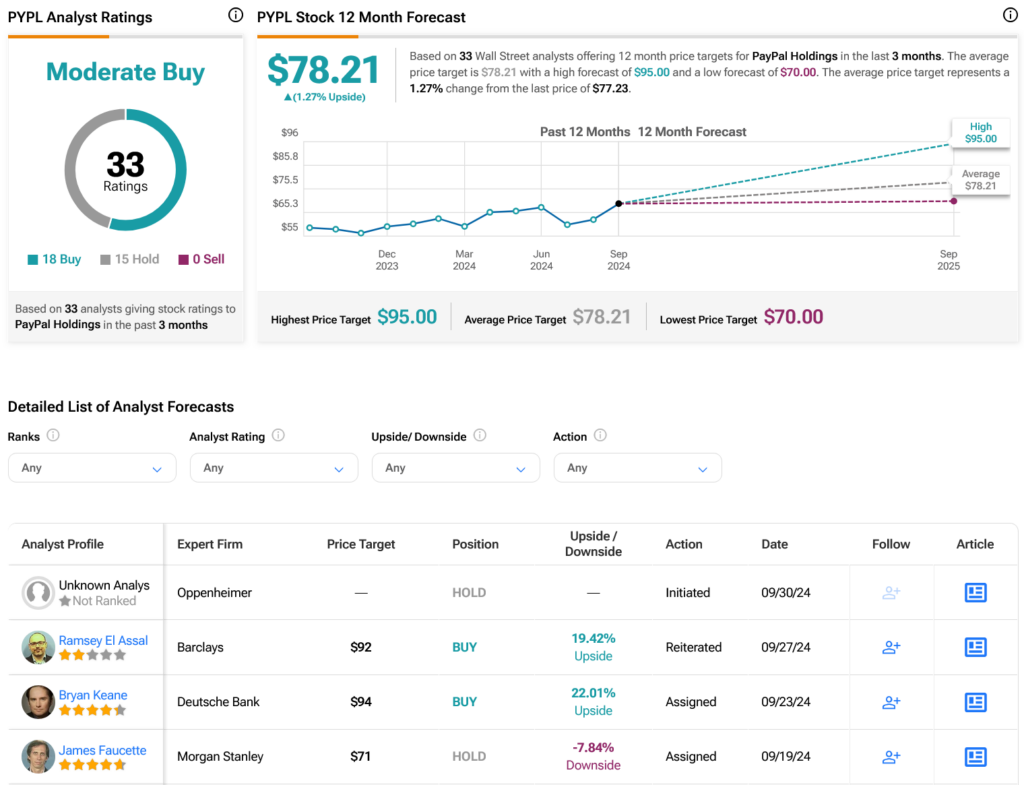

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PYPL stock based on 18 Buy and 15 Hold recommendations assigned in the past three months, as indicated by the graphic below. After a 31.56% rally in its share price over the past year, the average PYPL price target of $78.21 per share implies 1.27% upside potential.