PayPal Holdings (PYPL) has enhanced its partnership with Fiserv (FI) to increase the availability of its payment options for Fiserv’s large U.S. customer base. The deal will introduce Paypal’s Fastlane one-click checkout solution to Fiserv’s customers and make other payment options such as PayPal and Venmo more easily available to them.

Fastlane by PayPal allows users to complete purchases quickly and easily by eliminating the need to re-enter credit card and shipping information. At the same time, the Venmo app allows users to send and receive money directly from their bank accounts or debit cards. As part of the agreement, Fiserv will integrate both payment methods into its merchant platform.

It is worth highlighting that the partnership between PayPal and Fiserv extends over 10 years. Fiserv has been a key technology provider for PayPal and supported innovation across various domains and product lines. This existing relationship provides a strong base for the expanded collaboration.

Fastlane to Drive Growth

Fastlane has proven to be effective, with over 80% of guest shoppers completing their purchases using it, compared to just 50% of those who don’t use it. Additionally, Fastlane reduces checkout time by 32%. It should be noted that higher conversion rates indicate increased sales for merchants.

Of late, several companies have teamed up with PayPal to integrate Fastlane with their services, such as BigCommerce, Adyen (ADYYF), Adobe (ADBE), and Salesforce (CRM).

Given the rising adoption of Fastlane by companies, it would be reasonable to say that this feature could be a major growth driver for PayPal. As more merchants adopt Fastlane, PayPal can expand its customer base and boost its revenue.

Is PYPL a Buy, Sell, or Hold?

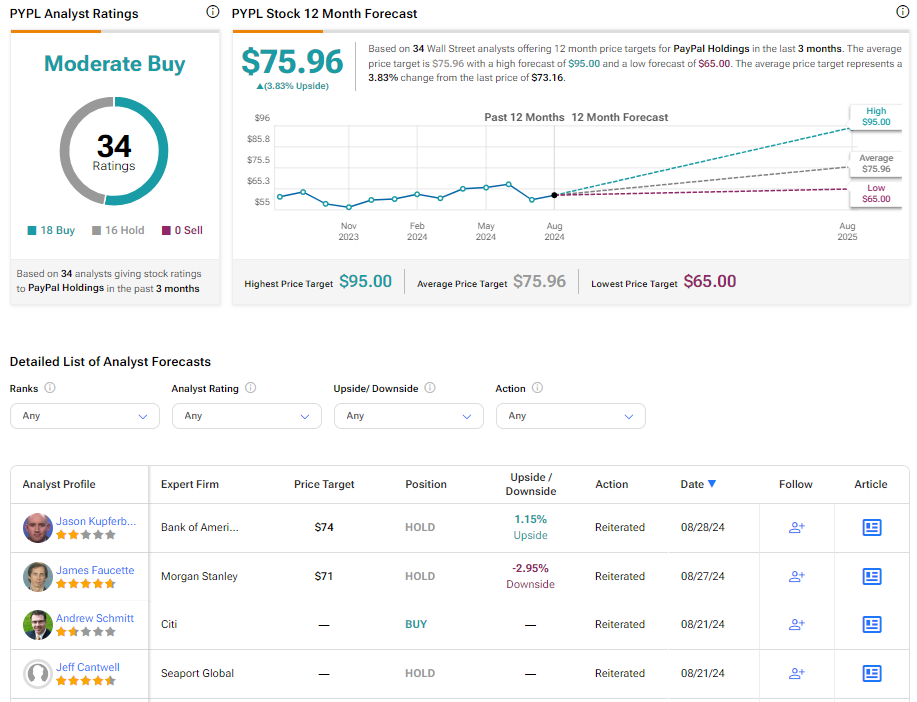

Overall, Wall Street analysts are cautiously optimistic about PYPL stock. It has a Moderate Buy consensus rating based on 18 Buy and 16 Hold recommendations. The analysts’ average price target on PayPal stock of $75.96 implies a 3.83% upside potential from current levels. The stock has gained 19.1% year-to-date.

Questions or Comments about the article? Write to editor@tipranks.com