Motion and control technologies provider Parker Hannifin Corporation (PH) inked an all-cash deal to buy all of the issued and outstanding shares of UK-based Meggitt Plc (MEGGF), a global provider of aerospace and defense motion and control technologies. Following the news, shares of PH fell 2.1%, closing at $305.46, and Meggitt jumped 55.7% to close at $10.12 on August 2. (See Parker Hannifin stock charts on TipRanks)

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The deal is valued at £6.3 billion ($8.8 billion), which represents a 70.5% premium to Meggitt’s closing share price on July 30.

The deal has been approved by the Boards of both companies and is subject to certain regulatory conditions and Meggitt shareholders’ approval.

Tom Williams, Chairman, and CEO of Parker Hannifin said, “We strongly believe Parker is the right home for Meggitt. Together, we can better serve our customers through innovation, accelerated R&D, and a complementary portfolio of aerospace and defense technologies.”

Parker expects the combination to be earnings accretive in the first full 12 months post-acquisition and also expects to achieve $300 million of pre-tax synergies in the third full year, post-closing of the acquisition.

The deal will double Parker’s Aerospace segment and boost the proportion of its business focused on the aerospace aftermarket by 500 bps.

The company believes that the acquisition will be strategically and culturally compelling, and the combined entity will stand to benefit from the recovering commercial aerospace market.

Following the news, KeyBanc analyst Jeffrey Hammond reiterated a Buy rating on the stock and lifted the price target to $375 (22.8% upside potential) from $350.

Overall, the stock commands a Strong Buy consensus rating based on 8 Buys and 1 Hold. The average Parker Hannifin price target of $360.44 implies 18% upside potential to current levels. Shares have gained 67.9% over the past year.

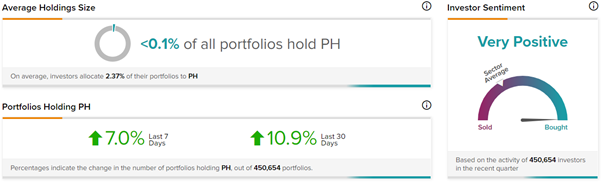

Also, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Parker Hannifin, with 10.9% of portfolios tracked by TipRanks increasing their exposure to PH stock over the past 30 days.

Related News:

ON Semiconductor Delivers Blowout Quarter; Shares Soar 11.7%

What Do IMAX’s Risk Factors Indicate?

Vista Outdoors Shares Jump on Blowout Q1 Results