On the surface, a change to severance packages for key executives at a company like entertainment giant Paramount (NASDAQ:PARA) might seem like a furious ball of nothing. But investors welcomed it like the second coming of the golden age of movie houses, sending shares up nearly 7% in Monday afternoon’s trading session.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The change in question focused on plans to offer severance benefits to executives if they’re let go within two years of a “change of control.” Executives impacted by this move include CEO Bob Bakish, as well as the CFO, the CPO (Chief People Officer), the General Counsel, and several others. For those wondering why such an oddly specific golden parachute is being deployed, there has been speculation that Paramount may ultimately be acquired by a different, larger entity, much in the same way MGM was.

Paramount Has More Going On Here

Here’s where things get interesting. Not only is Paramount engaging in an unusual promotion, but it’s also made some unexpected moves. It recently teamed up with several barber shops to offer free haircuts and such in celebration of the upcoming series “Lawmen: Bass Reeves.” Among the services offered were mustache modifications that would give customers the title character’s mustache or something reasonably similar. The series will follow other lawmen, eventually, as well as some criminals.

But the biggest move was that Paramount sold Bellator. The Professional Fighters League (PFL), a Saudi-backed institution, purchased the rights to Bellator from Paramount Global, which now puts it on par with UFC. No details were released about the size of the deal, but it’s a safe bet Paramount walked away with some big cash.

What is the Projection for Paramount Stock?

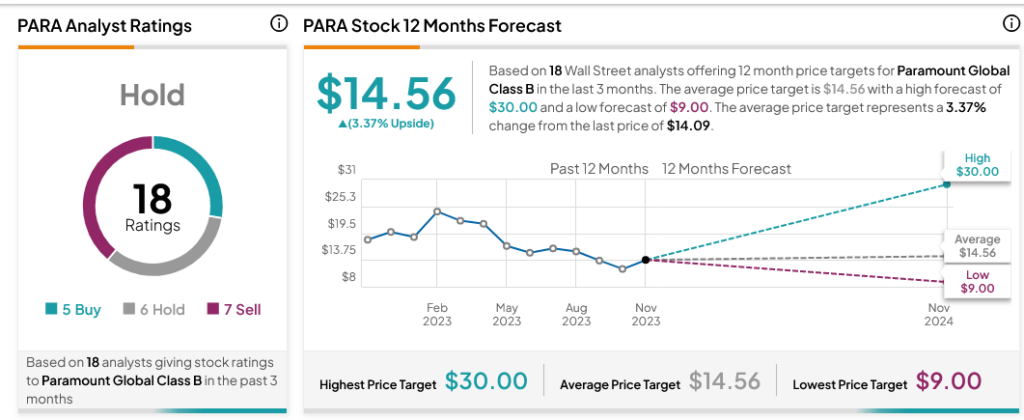

Turning to Wall Street, analysts have a Hold consensus rating on PARA stock based on five Buys, six Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 21.67% loss in its share price over the past year, the average PARA price target of $14.56 per share implies 3.37% upside potential.