One of the biggest hazards the Paramount Global (PARA) / Skydance merger faced was Mario Gabelli, who has threatened to sue the whole thing into oblivion. New reports suggest that he has not gone away.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

A report in the New York Post suggests that Gabelli is not out of the picture, but is rather “…trying to set things right…” with the new merger. Gabelli, a major name in money management circles, has been taking meetings with high-end legal guns in a bid to pursue “…a big payday for his clients,” noted the report.

The talks are all still early-stage, and seeing such a payoff materialize depends on a whole lot of moving parts coalescing. Gabelli claims that Paramount’s governance structure leaves it with multiple levels of ownership. All of them are at risk, Gabelli notes. But one major problem Gabelli found in trying to do this is that many law firms already do some kind of work for Paramount, thus, any work on behalf of its shareholders would be a difficult matter to say the least.

The Unexpected Pass

While most everyone in Hollywood has a story about how they were considered for one of the biggest roles around, but passed, a new report claims that Paramount kept Martin Scorsese out of the director’s chair for The Godfather Part II.

The Godfather Part II is one of those rare films that manages to surpass its predecessor. Sequels do not often do that. But director Francis Ford Coppola initially wanted nothing to do with it, instead suggesting Scorsese for the job. But Paramount would not take his suggestion, and the rest was history.

Is Paramount Stock a Good Buy?

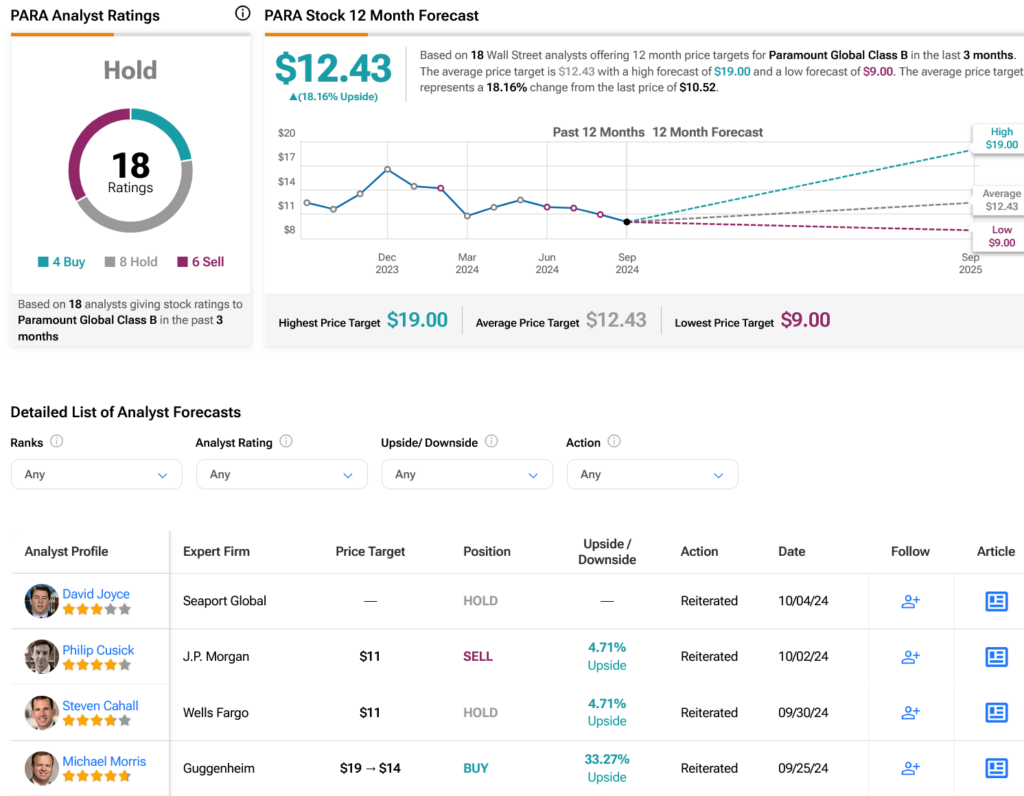

Turning to Wall Street, analysts have a Hold consensus rating on PARA stock based on four Buys, eight Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 10.67% loss in its share price over the past year, the average PARA price target of $12.43 per share implies 18.16% upside potential.