Paragon 28, Inc. (NYSE: FNA) has acquired Disior Oy to bolster its SMART 28 strategy for $18 million. The deal aims to provide a comprehensive 3D analytics and pre-operative planning platform, and accelerate internal research programs.

Paragon 28 is a leading medical device company with a primary focus on the foot and ankle orthopedic market. Shares of the company were down 3.6% following the news.

Benefits of the Deal

Based in Helsinki, Finland, Disior Oy is a developer of 3D medical imaging software for clinicians that provides 3D anatomical analysis in minutes. It is focused on the complex foot and ankle anatomy.

The addition of Disior Oy will significantly enhance FNA’s SMART 28, the company’s ecosystem that allows technologies for pre-operative planning, intra-operative assistance, and post-operative assessment. Likewise, the collaboration will lead to improved patient outcomes modernizing all aspects of foot and ankle surgery.

Furthermore, Disior’s anatomy-specific surgical modules will be highly complementary to Additive Orthopedics acquired by P28 in 2021.

Other Details

According to the terms of the deal, Paragon 28 has paid $18 million. Furthermore, incremental future payments of up to $8 million will be made, subject to the achievement of certain technological advancements and commercial milestones. Paragon 28 funded the deal by utilizing its existing term loan facility.

CEO Comments

Paragon 28 CEO, Albert DaCosta, commented, “Disior advances our previously communicated growth strategy to target unique technologies and will immediately accelerate our internal research and development efforts, plus provide surgeons unique pre-operative planning capabilities. Disior’s software combined with our broad product portfolio further differentiates us from the competition.”

Analysts Recommendation

Following the news, Needham analyst Michael Matson reiterated a Buy rating on Paragon 28, with a price target of $31 (88.2% upside potential).

Overall, the stock has a Strong Buy consensus rating based on 4 Buys. The average Paragon 28 stock price projection of $29.75 implies 80.6% upside potential from current levels.

Investors Weigh In

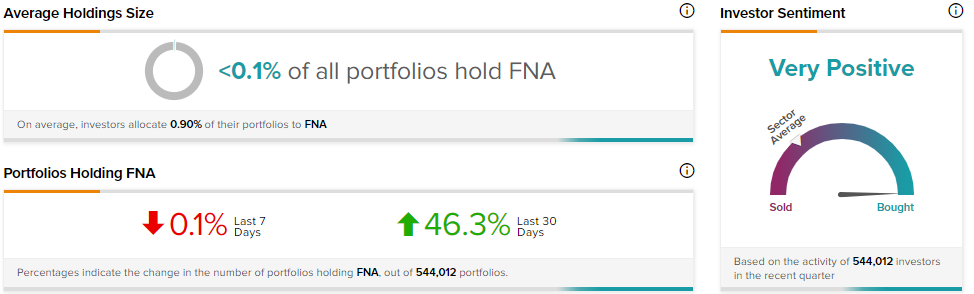

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Paragon 28, with 46.3% of investors increasing their exposure to FNA stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Albertsons Shares Tumble 9.7% Despite Q3 Beat & Raised Outlook

Nokia Confident to Beat 2021 Guidance; Initiates FY2022 Margin Outlook

Novavax COVID-19 Vaccine gets Approval in South Korea

Questions or Comments about the article? Write to editor@tipranks.com