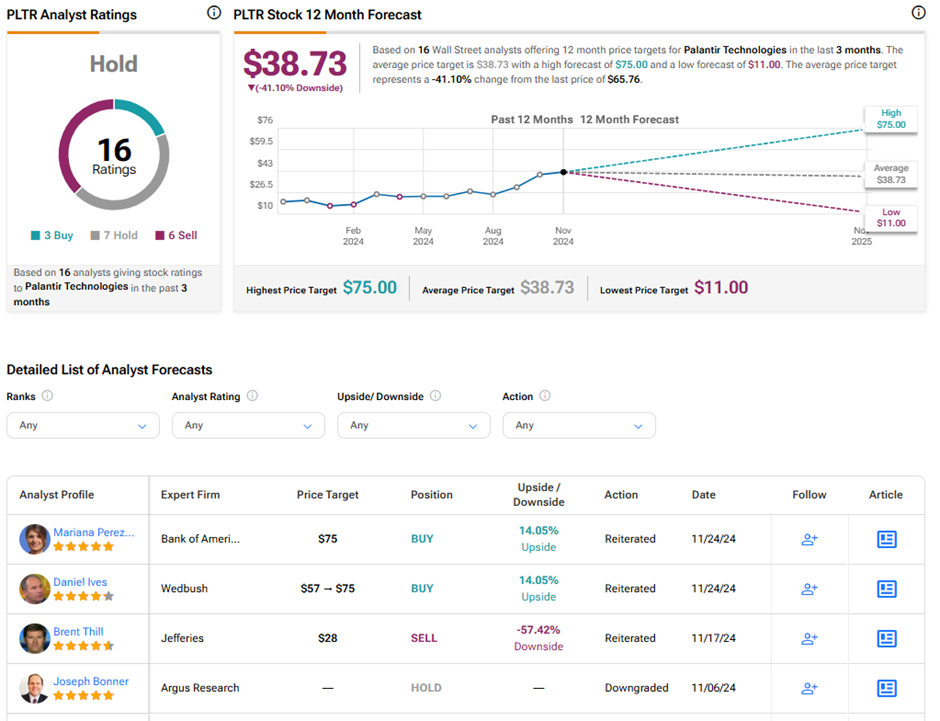

Artificial intelligence (AI) darling Palantir Technologies (PLTR) received a new Street-High price target of $75 from two Wall Street analysts amid its shift to the Nasdaq stock exchange. Bank of America analyst Mariana Perez Mora lifted the price target on PLTR to $75 from $50 and kept a Buy rating. Similarly, Wedbush analyst Daniel Ives raised the price target to $75 from $57, while reiterating a Buy rating on the stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As planned, Palantir stock started trading on the Nasdaq yesterday, and its shares flew nearly 2% higher in intraday trading. Analysts and investors alike have been enjoying the surge in Palantir’s stock in 2024 and await brighter days ahead, as the demand for AI keeps growing multifold.

BofA Sees High Room for Growth

BofA’s Mora believes that Palantir’s penetration in both government and commercial use cases is still in the initial stages and has high room for growth as these use cases multiply. For the coming three years, the analyst increased the government contract growth estimate to 29% from 24% and the commercial contract growth forecast to 34% from 32%. The analyst says that the good days for Palantir’s growth have only started and the company is yet to witness a significant boost.

The five-star analyst’s bullish view stems from Palantir’s competitive moat in digital enterprises and battlefield applications, which are useful in all sectors, including finance and military. More and more enterprises are expected to ramp up investments in software, and Palantir is expected to be a big beneficiary of this shift, given the need for its offerings in automation, data analysis, real-time monitoring, and other areas.

Finally, Mora believes that Palantir’s inclusion in the Nasdaq 100 index (NDX) could act as another catalyst for its stock.

Ives’ Bullish Stance on AI Software Stocks

Wedbush’s Ives believes that the next year will bring accelerated growth for the software sector, fueled by the ongoing artificial intelligence (AI) revolution. He added that the “software AI age” is here and accordingly, sees a significant demand for Palantir’s Artificial Intelligence Platform (AIP) offering in 2025.

AI is being used increasingly in different industries and applications, acting as a true catalyst for Palantir stock. This bullish view on the AI software sector propelled the price target for Palantir higher.

Is Palantir a Good Stock to Invest In?

Not all analysts share the same enthusiasm about Palantir stock’s trajectory, considering its heightened valuation and industry-high multiples. Jefferies analyst Brent Thill predicts that PLTR stock will crumble to $28 (56.7% downside potential) and has a Sell rating on the stock.

With a majority of analysts giving a Hold or Sell signal on the stock, PLTR stock has a Hold consensus rating on TipRanks. Also, the average Palantir Technologies price target of $38.73 implies 41.1% downside risk from current levels. Year-to-date, PLTR shares have surged nearly 283%.