Palantir Technologies, Inc. (PLTR) has been awarded a contract worth $59.5 million by the National Institutes of Health (NIH) to continue to provide a secure cloud-based data enclave to gather COVID-19 research data.

Shares of the data analytics company have gained 157% over the past year. (See Palantir stock charts on TipRanks)

Per the terms of the indefinite-delivery-indefinite-quantity (IDIQ) contract, Palantir will support the National COVID Cohort Collaborative (N3C) and its data enclave over two years, with an initial order over the first five months worth $7.9 million.

The N3C Data Enclave, currently one of the largest collections of COVID-19 health records globally, is a partnership among more than 70 institutions to centralize data on COVID-19 for clinical research, with over 8 million records.

Furthermore, Palantir has won a separate contract with the National Center for Advancing Translational Sciences (NCATS) to offer its software to speed up cancer research with the National Cancer Institute (NCI), as well as efforts to support the President’s Emergency Plan for AIDS Relief (PEPFAR).

Originally, valued at $36 million for one year, the contract has been extended for one more year for a total value of $60 million.

Akash Jain, President at Palantir USG, commented “We are very excited to continue our work with NCATS and the research community to support this critical resource in the fight against COVID-19 as well as to study long COVID and potentially other diseases that pose major public health challenges.”

Following the news, William Blair analyst Kamil Mielczarek reiterated a Sell rating on the stock.

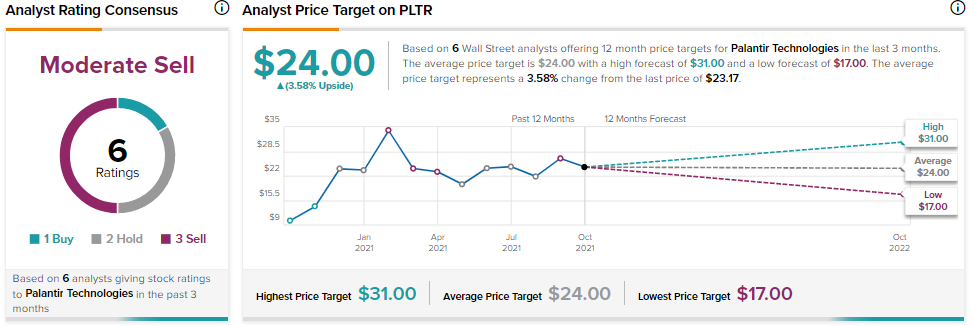

According to TipRanks’ analyst rating consensus, PLTR is a Moderate Sell based on 1 Buy, 2 Hold, and 3 Sell ratings. The average Palantir price target is $24, implying 3.6% upside potential.

Related News:

KDP Unveils $4B Share Buyback Program; Reiterates FY2021 Outlook

Earthstone Energy Snaps Up Assets in Midland Basin for $73.2M

GFL Environmental Snaps up Peoria Disposal Company