Palantir Technologies (PLTR) has teamed up with Origin Materials, the global leader of carbon-negative materials, to form a strategic alliance to speed up the world’s evolution to net-zero carbon emissions.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Palantir Technologies is a software company that specializes in enterprise data platforms, enabling organizations to optimize complex and sensitive data environments. Shares of the company were down 2.4% to close at $24.41 on June 15.

The combination of Origin’s expertise and technology with Palantir’s data integration and modeling capabilities will focus on decarbonizing the global materials supply chain.

Origin Materials is now a Palantir customer and will use the latter’s Foundry technology to speed up its internal operations. (See PLTR stock analysis on TipRanks)

PLTR’s COO Shyam Sankar commented, “We are deeply energized by Origin’s meaningful progress against the world’s net zero ambition…Our platform is uniquely suited to support the decarbonization of complex global supply chains. Customers across dozens of industries are using Foundry to build a carbon-focused common operating picture that allows them to track live emissions, simulate scenarios based on emerging technologies and regulations, and make real-time changes to their business.”

Furthermore, both companies plan to explore several opportunities across various industries to bring down the environmental impact.

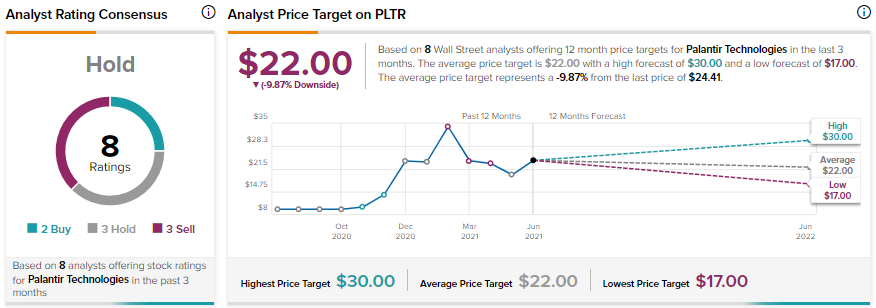

Citigroup analyst Tyler Radke recently maintained a Sell rating and the price target of $17 (30.4% downside potential) on the stock.

Radke said, “We still see a difficult set-up for the stock as growth decelerates in the second half and overall commercial revenue growth remains subdued.”

Overall, the stock has a Hold consensus rating based on 2 Buys, 3 Holds, and 3 Sells. The PLTR average analyst price target of $22 implies 9.9% downside potential from current levels. Shares of PLTR have jumped 144% since its IPO on September 30, 2020.

Related News:

Clean Energy Reveals Plans to Develop Natural Gas From Dairies; Shares Roar

Bentley Systems Snaps Up SPIDA to Accelerate its Grid Resilience

Bank of America Expands Financial Centers in Kentucky