Shares of software company Palantir Technologies (NYSE:PLTR) continue to be in the spotlight. In the latest development, Palantir has secured a $480 million contract from the U.S. Department of Defense for a prototype known as the Maven Smart System. This comes after the company’s management said during the Q1 conference call that PLTR continues to pursue defense opportunities and expects growth in the U.S. government business throughout 2024.

It’s worth noting that Palantir’s Q1 government revenue grew 16% year-over-year and 3% sequentially to $335 million. Moreover, its Q1 U.S. government revenue jumped 12% year-over-year and 8% sequentially to $257 million.

Palantir, Eaton Expand Partnership

In a separate story, Palantir and power management company Eaton Corporation (NYSE:ETN) announced the expansion of their partnership. Per the terms of the deal, Eaton will now integrate Palantir’s Artificial Intelligence Platform (AIP) into its operations.

Previously, the two companies developed an AI-assisted workflow for Eaton’s supply chain team.

It’s worth noting that Palantir’s AI platform is leading the company to win new customers and is driving its deal size. For instance, Palantir’s customer count grew 42% year-over-year and 11% quarter-over-quarter in Q1 of fiscal 2024. Moreover, its U.S. commercial customer count grew 69% year-over-year to 262.

Thanks to this solid growth, PLTR stock has gained nearly 22% year-to-date and over 42% in one year.

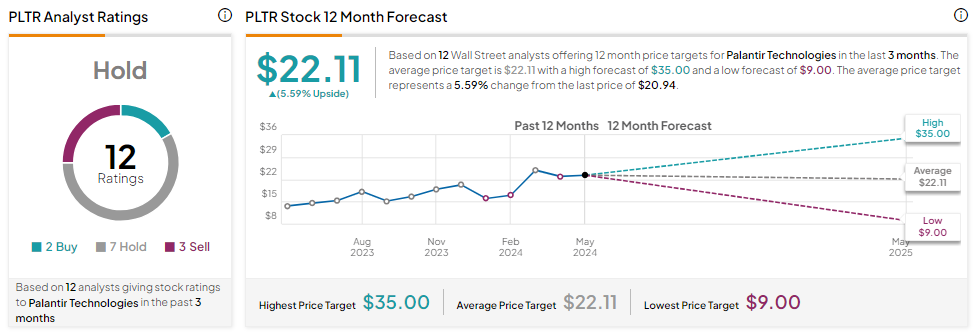

Is PLTR a Buy, Sell, or Hold?

Palantir’s AIP positions it well to capitalize on the AI demand. The accelerated pace of new customer acquisition and higher deal size will likely support its margins. However, the notable increase in PLTR stock keeps analysts sidelined.

With two Buys, seven Holds, and three Sell recommendations, PLTR stock has a Hold consensus rating. The analysts’ average price target for PLTR stock is $22.11, implying a limited upside potential of 5.59% from current levels.