Palantir Technologies (PLTR) stock gained over 11% on Thursday after it announced a partnership with Microsoft (MSFT). The two companies are teaming up to provide enhanced cloud, analytics, and artificial intelligence (AI) capabilities to the U.S. Defense and Intelligence Community.

The collaboration will integrate Palantir’s AI Platforms (AIP) with MSFT’s Azure OpenAI Service within secure government cloud environments. This goal is to provide government agencies with a unified set of advanced AI tools for important national security missions.

To support the adoption of these new capabilities, both companies will offer boot camp training programs for government personnel.

Government Contracts to Boost PLTR’s Growth

Palantir’s AI Platform (AIP) has played a crucial role in its recent success. The company’s ability to translate complex AI technology into practical applications for government clients has fueled its growth.

In the Q2 earnings release, announced on August 5, the company reported a 24% year-over-year increase in government revenue. Moreover, CEO Alex Karp highlighted PLTR’s growing dominance in the U.S. government market, with revenue surpassing $1 billion over the past 12 months.

It is worth mentioning that according to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” bullish analysts believe that the company’s AI capabilities help drive demand across commercial and government sectors. This is because more customers are using its platform to achieve efficiency gains beyond just chat applications.

Is PLTR a Good Stock to Buy?

The strategic alliance with Microsoft could enhance Palantir’s position as a leading provider of data analytics and AI solutions for government agencies. This partnership is expected to drive future growth and expand the company’s market presence.

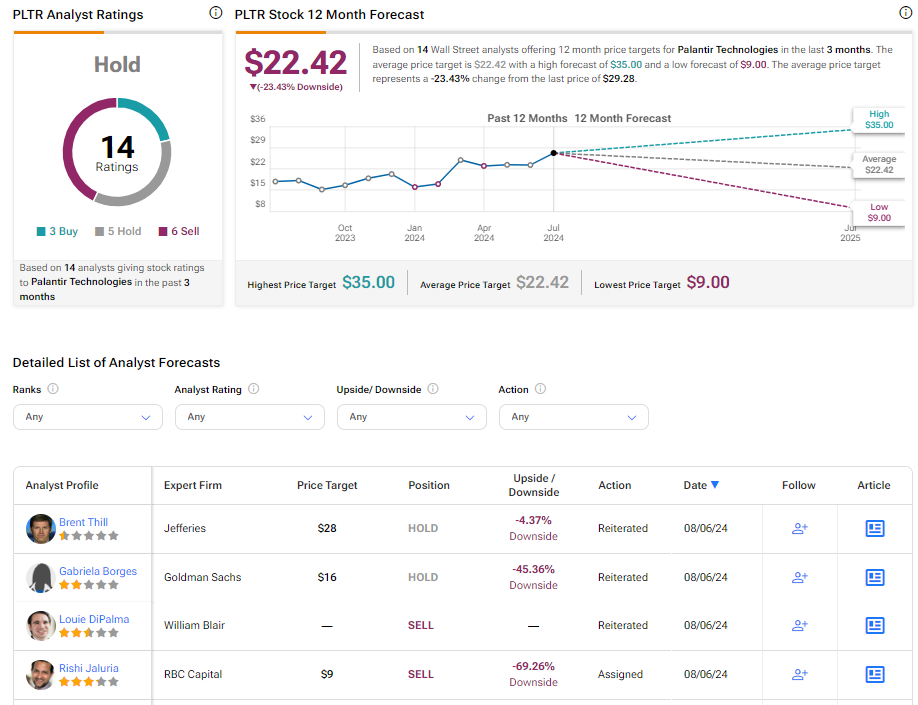

Overall, Wall Street analysts are sidelined on PLTR. It has a Hold consensus rating based on three Buy, five Hold, and six Sell recommendations. The analysts’ average price target on Palantir stock of $22.42 implies a 23.43% downside potential from current levels. Year-to-date, the stock has gained 70.5%.