Shares of big data analytics company Palantir (NYSE:PLTR) surged in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $0.08, which was in line with analysts’ consensus estimates. Sales increased by 19.6% year-over-year, with revenue hitting $608.35 million. This beat expectations by $5.6 million.

Commercial revenue saw an impressive year-over-year increase of 32%, reaching $284 million. The U.S. commercial sector particularly stood out, with a 70% growth rate and $131 million in revenue. On the government side, revenue grew by 11% from the previous year, coming in at $324 million. In terms of clientele, there was a notable 35% year-over-year growth.

Looking forward, management now expects revenue and adjusted income from operations for Q1 2024 to be in the ranges of $612 million to $616 million and $196 million to $200 million, respectively. For Fiscal Year 2024, revenue is anticipated between $2.652 billion and $2.668 billion, with adjusted income from operations of $834 million to $850 million.

What Is the Prediction for PLTR Stock?

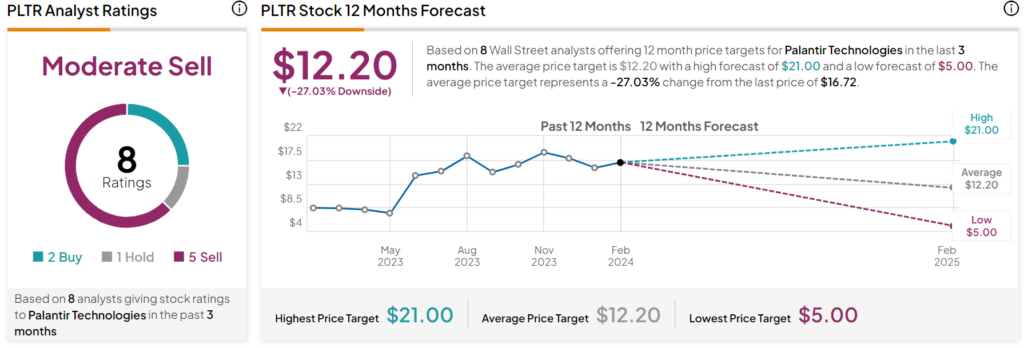

Turning to Wall Street, analysts have a Strong Buy consensus rating on PLTR stock based on two Buys, one Hold, and five Sells assigned in the past three months, as indicated by the graphic below. After a 100% rally in its share price over the past year, the average PLTR price target of $12.20 per share implies 27% downside risk.