Recently, Wedbush analysts had some great things to say about software maker Palantir (NYSE:PLTR), and Wedbush was far from alone on that front as well. But despite the outpouring of positive sentiment, investors still pulled out of Palantir stock at a pretty brisk clip, leaving it down over 2% in Tuesday morning’s trading session.

Wedbush, via analyst Dan Ives, noted that the AIP conference that Palantir held last week was chock full of exciting news and assorted tidbits that, when gathered together, made for a pretty impressive overall picture. Specifically, Ives cited the “range of industries” that Palantir was working with, everything from transportation and logistics to financial services and manufacturing. Perhaps even better, Ives pointed out that “…the Palantir offering isn’t just a product base, it is a hand-engineered solution for its customers’ exact pain points.”

And that’s not the end of the positive sentiment, either. Other analysts have pointed out a “reset in valuation” alongside a stock buyback plan supported by a cool billion dollars in cash. Palantir’s commercial revenue growth is on the rise, even to the point where it’s poised to surpass its government revenue growth. Its focus on GAAP profitability should make it more attractive to investors, too, so why are they leaving today? Maybe it’s a matter of valuation. Maybe they think it’s close to the ceiling right now and could use a bit of pullback while it gets these issues in order.

What is the Target Price for Palantir Stock?

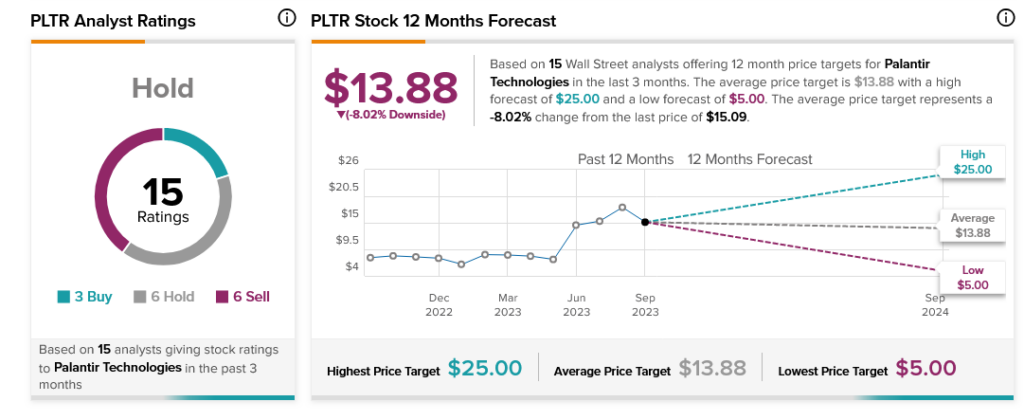

The broader body of analysts isn’t exactly on Palantir’s side. With three Buy ratings, six Holds, and six Sells, Palantir stock is consensus-rated a Hold. Further, with an average price target of $13.88, Palantir stock comes with a concerning 8.02% downside risk, which could be the reason investors are pulling back: to skim profits and buy in later.

Questions or Comments about the article? Write to editor@tipranks.com