Shares of PagerDuty were down about 4.5% in Wednesday’s extended trading session after the software company projected a wider-than-expected loss for 1Q and fiscal 2022.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Nevertheless, PagerDuty’s (PD) 4Q results fared well versus the Street’s estimates. Moreover, the company forecasted 1Q and FY22 revenues that came in better than analysts’ estimates.

PagerDuty’s 4Q adjusted loss of $0.07 per share worsened from the year-ago period’s adjusted loss of $0.03 per share due to higher operating losses. However, it came in better than the analysts’ expectations of a loss of $0.11 per share. The company’s revenues grew 29.1% year-over-year to $59.3 million and came in above consensus estimates of $57.5 million.

CEO Jennifer Tejada said that “During fiscal 2021 we continued to see strength in the enterprise and mid-market, with total dollar-based net retention of 121 percent and enterprise dollar-based net retention above 125 percent exiting the year.”

As for 1Q, the company expects sales in the range of $61-$63 million, higher than analysts’ expectations of about $60.96 million. Furthermore, for fiscal 2022 (ending Jan. 31, 2022), the company expects to generate revenues in the range of $264-$270 million versus consensus estimates of $262.6 million. (See PagerDuty stock analysis on TipRanks)

However, the company anticipates a 1Q loss in the range of $0.09-$0.10 per share, wider than analysts’ expectations for a loss of $0.07 per share. PagerDuty projects a loss for fiscal 2022 in the range of $0.36-$0.43 per share. Analysts were anticipating a loss of $0.21 per share for fiscal 2022.

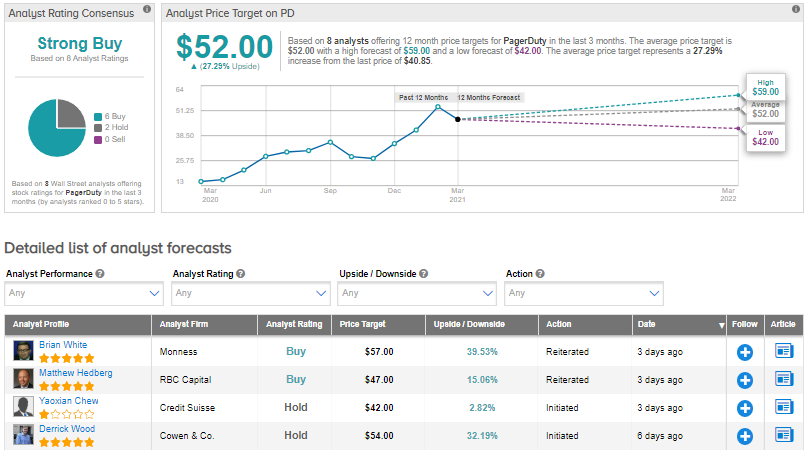

Befotre the results, Monness analyst Brian White maintained a Buy rating and a price target of $57 (39.5% upside potential). In a note to investors, the analyst said, “PagerDuty has an exciting opportunity in the real-time digital operations market, playing squarely into the digital transformation trend, but with a more modest valuation compared to other next-gen software vendors.”

Turning now to the rest of the Wall Street community, PagerDuty has a Strong Buy consensus rating based on 6 Buys and 2 Holds. The average analyst price target of $52 implies upside potential of about 27.3% to current levels. Shares have rallied 217.4% in one year.

Related News:

Steel Dynamics 1Q Profit Outlook Tops Estimates

Five Below Pops 5.7% After Posting A Blowout Quarter

Progressive Slips Despite A Five-Fold Jump In February Earnings