With a forward dividend yield of 1.1%, it’s easy for dividend investors to overlook shares of PACCAR (NASDAQ:PCAR). But this truck maker is an underrated dividend powerhouse despite this seemingly unassuming yield. In fact, it’s a stock that should be on the radar of all dividend investors, as we’ll discuss in this article.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

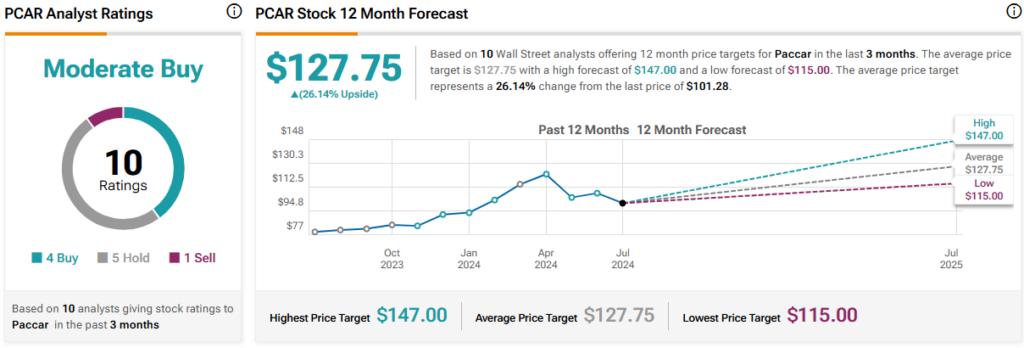

I’m bullish on shares of PACCAR based on its compelling combination of regular and special dividends, as well as its modest valuation. Plus, analysts collectively see potential upside of 26.1% over the next 12 months for this $53 billion market cap stock.

What Is PACCAR?

PACCAR manufactures and sells light, medium- and heavy-duty trucks. It’s known for its premium brands like Peterbilt and Kenworth, which it primarily sells in North America and Australia, as well as its DAF brand, which it mostly sells in Europe and South America. The company has been around since 1905.

In addition to manufacturing these high-quality trucks, Paccar also operates two other business segments — its parts business, PACCAR Parts, and its financing arm, PACCAR Financing. Parts and Financing are continually growing to make up a larger percentage of the company’s profits over time, making Paccar less reliant on profits from the truck business, which can be more cyclical in nature.

PCAR is also positioning itself for the future of trucking. The company has invested significantly in research and development on both autonomous vehicles and electric vehicles and even hydrogen-powered trucks. Even PACCAR’s traditional combustion engine trucks are known for their fuel efficiency, which will behoove the company as more countries around the world introduce stricter emissions standards.

Why PACCAR Is an Underrated Dividend Stock

PACCAR’s status as a powerful dividend stock is front and center to its investment allure. Now, this may sound a bit odd for a stock with a dividend yield of just 1.1%, and understandably so. But this 1.1% yield doesn’t tell the whole story.

That’s because PACCAR has been supplementing its regular quarterly dividend payouts with a large special dividend payout each year for the past 14 years. And the level of these special dividends can be significant, often dwarfing the total of the quarterly dividends Paccar pays out during the year.

For example, in 2023, PACCAR paid two quarterly dividends of $0.25 in the first half of the year before increasing its payout to $0.27 and making two quarterly payments in this amount for the latter half of the year. This came out to a total of $1.04 in quarterly dividend payments per share.

Paccar then rewarded its shareholders by paying more than triple this amount with a special dividend payment of $3.20 for the year (paid out at the start of the following year on January 4, 2024).

If we were to add this $3.20 special dividend to the quarterly dividends and include it as part of Paccar’s yield, then PACCAR’s trailing 12-month yield would be a much more enticing 4.2% based on its current share price.

These special dividends are not guaranteed, and the level can vary from year to year, but PACCAR generates plenty of free cash flow, and it has been paying special dividends for 14 years in a row, so it seems likely that it will be able to continue to do so, going forward. The company has delivered dividends that typically amount to approximately 50% of its net income for years. Further to this point, UBS recently named Paccar to a list of high-quality stocks that pay dividends that are unlikely to be cut.

PACCAR’s propensity for paying shareholders these special dividends each year, in addition to its regular quarterly payouts, greatly enhances its attractiveness as a dividend stock. PACCAR also deserves credit for the longevity of its dividend. The firm has paid dividends for 33 consecutive years and counting.

Attractive Valuation

Even after a strong rally in which the stock has gained 23.7% over the past year, shares still trade at a surprisingly undemanding valuation of just 12.3 times 2024 earnings estimates. This is remarkably cheap compared to the broader market. The S&P 500 (SPX) trades at 22.7 times forward earnings.

Is PCAR Stock a Buy, According to Analysts?

Turning to Wall Street, PACCAR earns a Hold consensus rating based on four Buys, five Holds, and one Sell rating assigned in the past three months. The average PCAR stock price target of $127.75 implies 26.1% upside potential from current levels.

PACCAR Is Ready to Keep Trucking

In conclusion, while PACCAR yields just 1.1% on a forward basis, this is an underrated powerhouse dividend stock. I’m bullish on PACCAR based on its compelling combination of regular and special dividends, along with its attractive valuation. The fact that sell-side analysts see potential upside of nearly 30% over the next 12 months adds to my bullishness on the stock.