Outbrain (OB) reported its first public quarterly financials after its IPO in July. OB’s third-quarter results demonstrated strong top-line performance and profitability, and it also increased its full-year fiscal 2021 guidance for certain metrics.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

However, the company’s shares fell 4.3% on the news, closing at $16.05 on November 11.

The company is a leading discovery platform dedicated exclusively to predicting moments and drawing data-driven connections between interests and actions for the open web.

See Analysts’ Top Stocks on TipRanks >>

Solid Quarterly Results

Outbrain’s revenue rose 34% year-over-year to $250.78 million, higher than analysts’ estimates of $241.4 million. The solid revenue growth was aided by a 28% increase in revenue contribution from existing media partners, and a 7% growth from new media partners.

Furthermore, the company reported an adjusted net income of $6.6 million, up 7% against the prior-year quarter.

The company’s reported net loss included, one-time pre-tax expenses related to the exchange of senior notes upon IPO, and cumulative incremental stock-based compensation expenses, for awards with an IPO performance condition.

Management Comments

Yaron Galai, co-founder and co-CEO of Outbrain, said, “We are building products that drive meaningful value for our media partners and advertisers as reflected in our record performance… At the same time, we continue to expand our long-term investments in data science, innovation, and quality, all of which position us well for the future. The focus on our core business is paying off in our wins of new media partners and renewals of key partners.”

Wall Street’s Take

Responding to Outbrain’s quarterly performance, JMP Securities analyst Andrew Boone reiterated a Buy rating on the stock with a price target of $32, which implies 99.4% upside potential to current levels.

Boone said, “3Q21 results were solid and reaffirm our thesis that Outbrain is driving advertiser performance and financial results through a steady cadence of new product releases and algorithm optimizations. Importantly, we believe this can continue as new product adoption ramps and Quality Rating is now under testing with CEO Galai calling it the “most significant algorithm” in recent years.”

Moreover, the analyst also believes that OB has built a highly defensible business model with its multi-year exclusive publisher contracts, and robust network of performance advertisers.

With five Buys and one Hold, the stock commands a Strong Buy consensus rating. The average Outbrain price target of $25.67 implies 59.9% upside potential to current levels. However, shares have lost 19.8% since their July listing.

Website Traffic

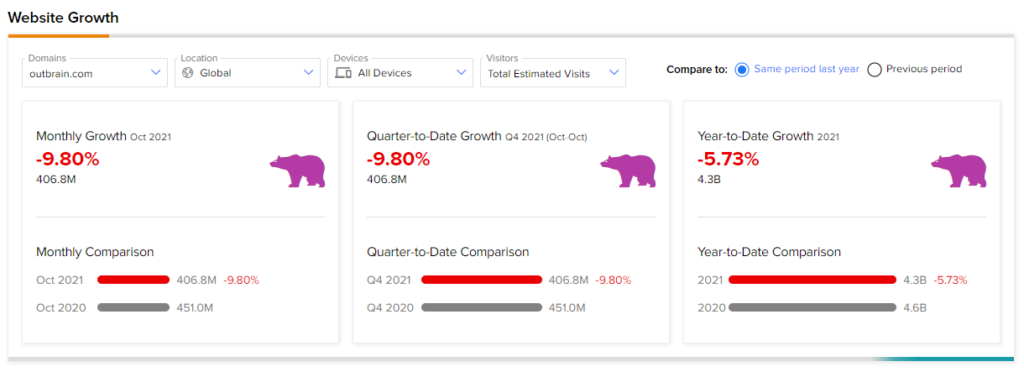

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into OB’s performance.

In October, Outbrain website traffic recorded a 9.8% monthly decline in visits, against the same quarter last year. Likewise, year-to-date website traffic growth decreased 5.73% compared to the same period last year.

Related News:

ContextLogic Down 4.3% Despite Q3 Beat

Monday.com Plunges 21% Despite Outstanding Q3 Results

Hershey to Buy Two Pretzel Brands for $1.2B