Shares of Oracle (ORCL) surged in after-hours trading after the tech firm reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at $1.39, which beat analysts’ consensus estimate of $1.33 per share. This comes after last quarter’s rare miss, as Oracle was on a six-quarter win streak.

Sales increased by 6.8% year-over-year, with revenue hitting $13.3 billion. This beat analysts’ expectations of $13.243 billion. This revenue increase was mainly driven by the company’s Cloud Revenue segment, which increased by 21% to $5.6 billion. What’s interesting is that Oracle’s Cloud business is causing the firm’s overall operating income growth, along with earnings per share growth, to accelerate, according to CEO Safra Catz. In addition, Cloud Services are now the company’s largest business.

However, what might have really excited investors was that Oracle also revealed new partnerships with Amazon Web Services (AWS) (AMZN) and Google (GOOGL). The partnerships are referred to as Oracle Database@AWS and Oracle Database@Google Cloud. This allows customers to use Oracle Autonomous Database and Oracle Exadata Database Service directly on AWS and Google.

Insider Activity

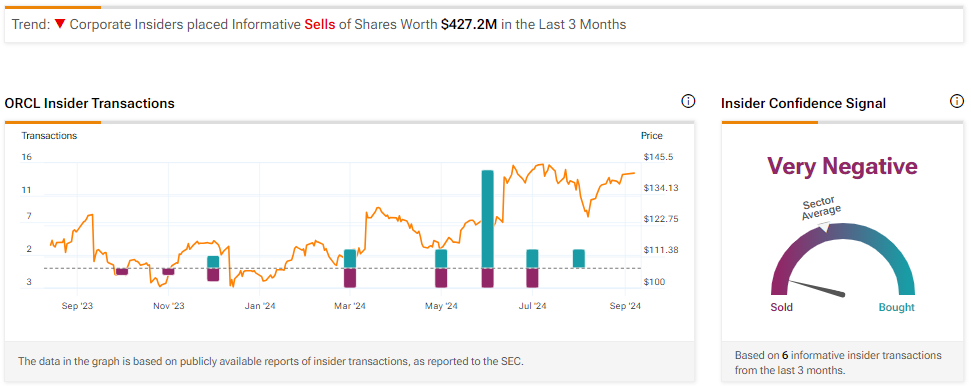

When looking at insider activity, there seems to be a lot of selling. In fact, insiders have sold $427.2 million worth of ORCL shares in the past three months. The most notable transaction was a $322,035,821 informative sale from Director, Chief Technology Officer, and over 10% owner, Larry Ellison. As a result, the overall Insider Confidence Signal for ORCL is currently very negative.

Nevertheless, it’s important to note that Ellison still has over $162 billion tied up in Oracle. Therefore, although his sale seems huge, it’s actually just a very small piece of his entire net worth that was probably due to personal reasons or outside investments.

Is Oracle a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 14 Buys, 13 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 13% rally in its share price over the past year, the average ORCL price target of $150.43 per share implies 6.08% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.