Oracle Corporation (ORCL) has unveiled plans to invest over $6.5 billion to establish its first public cloud region in Malaysia, marking a significant step in the country’s digital transformation journey. This investment is poised to be one of the largest single tech investments in Malaysia’s history, surpassing Amazon’s (AMZN) previous commitment of $6.2 billion for its AWS cloud infrastructure.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Oracle’s new public cloud region will enable Malaysian organizations to update their applications and move their data to the cloud. Customers will also have access to advanced AI tools, including the OCI Supercluster, the largest AI supercomputer in the cloud.

Oracle’s investment highlights the growing demand for cloud services and AI technologies in Malaysia as the country embarks on a comprehensive digital transformation.

Oracle Aims to Expand Cloud Across Asia

Oracle’s commitment to Malaysia is part of a broader strategy to expand its cloud and AI infrastructure throughout the Asia-Pacific region. The company plans to establish additional cloud regions, contributing to the growth of the digital economy across Southeast Asia.

It’s important to highlight that companies like Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOGL) have also made substantial investments in cloud services and data centers, fueling an infrastructure boom in response to rising demand for artificial intelligence (AI) capabilities.

Is Oracle a Buy, Hold, or Sell?

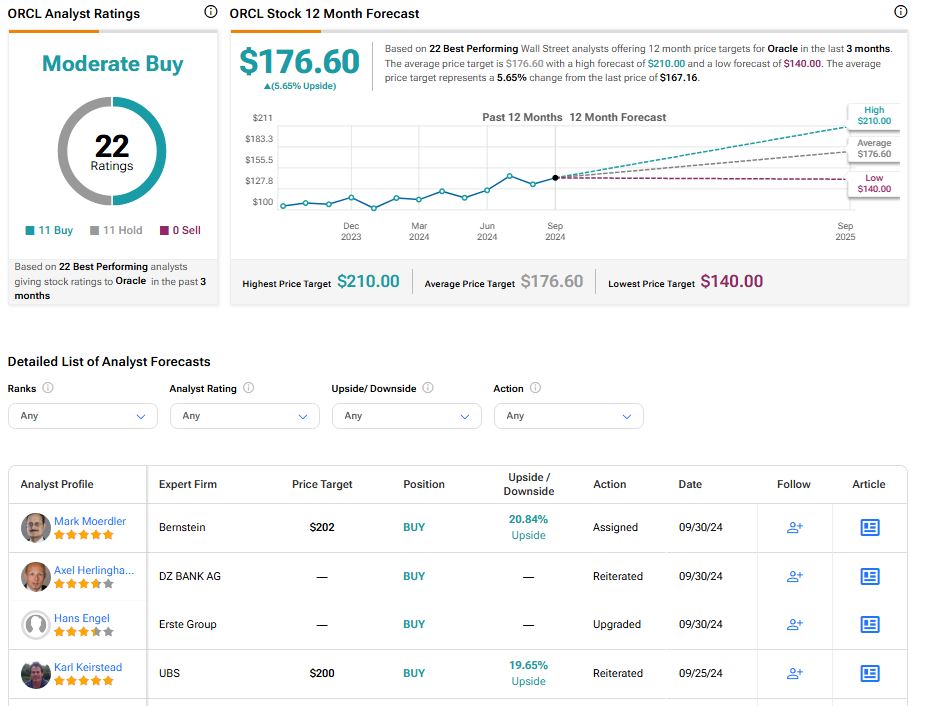

Overall, analysts have a Moderate Buy consensus rating on Oracle stock based on 11 Buys, 11 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 59% rally in its share price over the past year, the average ORCL price target of $176.60 per share implies 5.65% upside potential.