Oracle posted better-than-expected 2Q results as increased demand for its cloud services drove revenues and earnings higher.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Oracle’s (ORCL) 2Q revenues increased 2% to $9.80 billion and surpassed analysts’ expectations of $9.79 billion. Its adjusted earnings jumped 19% to $1.06 per share and topped the Street forecast of $1.

“Our highly profitable multi-billion dollar Fusion and NetSuite Cloud ERP applications businesses grew revenue 33% and 21% respectively in Q2,” Oracle CEO Safra Catz said. “These two strategic cloud applications businesses are major contributors to Oracle’s increased operating earnings and consistent earnings per share growth. (See ORCL stock analysis on TipRanks).

Additionally, Oracle approved a quarterly cash dividend of $0.24 per share to be payable on Jan. 21 to shareholders of record date as of Jan 7. At yesterday’s closing price of $59.48, the annualized dividend yield stands at 1.61%.

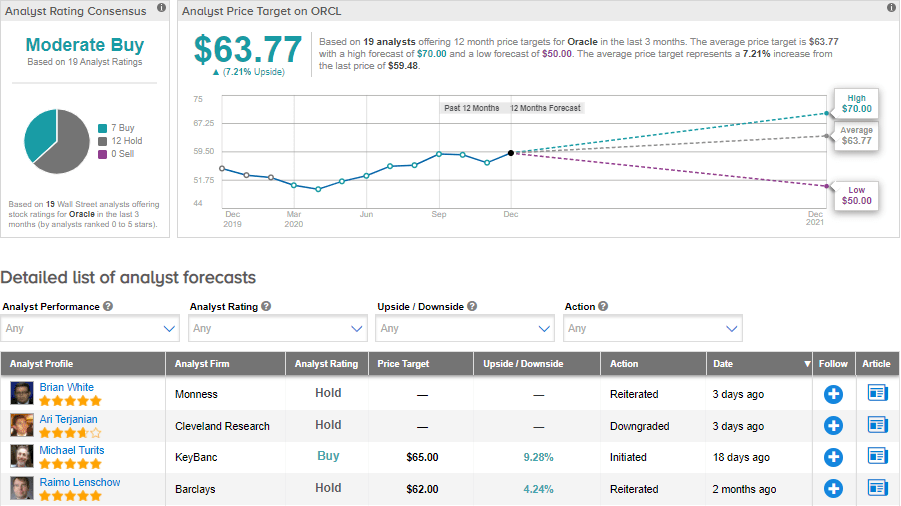

On Dec. 8, Monness analyst Brian White reiterated his Hold rating on the stock. In a note to investors, White wrote, “In our view, Oracle offers a valuable, differentiated cloud proposition; however, the company has struggled to string together consecutive quarters of strong performance and we expect its cloud push will take more time to monetize.”

Overall, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 7 Buys and 12 Holds. The average price target stands at $63.77 and implies upside potential of about 7.2% to current levels. Shares have gained 12.3% year-to-date.

Related News:

FireEye Sinks 13% After Cyberattack Hit; Citigroup Says Hold

Asana Spikes 16% On 3Q Beat, FY21 Guidance

Stratasys Gains On $100M Origin Deal; Needham Sticks To Hold