Oracle (ORCL), a computer technology company, is set to release its Q2 FY25 results on December 9. Wall Street analysts expect the company to report earnings of $1.48 per share for Q2, up 10.4% year-over-year. Revenues are also expected to rise by 9% year-over-year, reaching $14.12 billion for the quarter.

Oracle shares are up about 81% year-to-date, driven by booming cloud growth and rising profitability. It’s worth noting that ORCL has had a strong track record when it comes to beating earnings. The company has surpassed estimates seven times in the past nine quarters.

Analysts’ Opinions Ahead of Oracle’s Q2 Earnings

Ahead of Oracle’s Q2 results, Bernstein analyst Mark Moerdler reiterated a Buy rating on the stock with a price target of $202 per share. Moerdler believes that Oracle is well-positioned in the cloud infrastructure market, thanks to its Generation 2 Oracle Cloud Infrastructure (OCI). He contends that OCI’s unique design gives Oracle an edge over other cloud providers.

On financial front, Moerdler expects the company’s revenue and margins to continue to expand in the near future.

Also, according to TipRanks’ Bulls Say, Bears Say tool pictured below, bullish analysts highlight that Oracle’s strong performance is fueled by significant growth in its cloud segment. They argue that Oracle’s OCI Gen 2 is well-positioned to capture niche markets, giving Oracle room to grow further. However, bearish analysts worry about rising competition and slow adoption of Oracle Cloud by big companies.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting an 8.61% move in either direction.

Is ORCL a Good Stock to Buy?

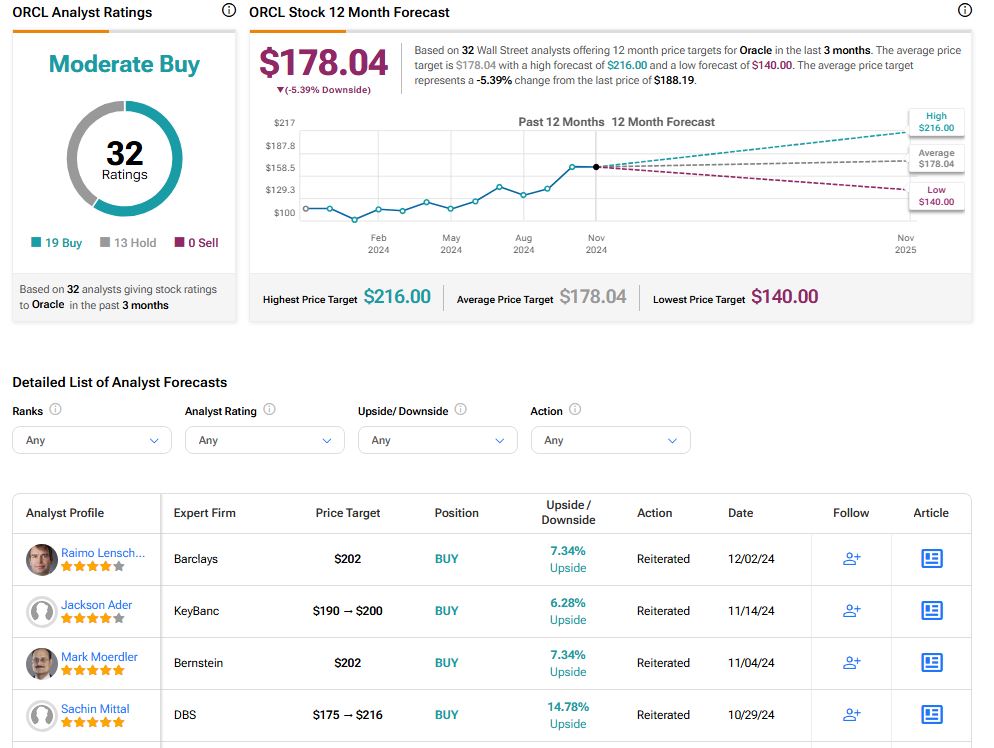

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Oracle stock based on nineteen Buys and thirteen Hold ratings assigned in the past three months, as indicated by the graphic below. The average ORCL price target of $178.04 per share implies 5.39% downside potential.