Texas-based software firm Oracle Corp. (ORCL) is in late-stage talks to acquire healthcare IT firm Cerner Corp. (NASDAQ:CERN) for nearly $30 billion, The Wall Street Journal said, citing people familiar with the matter

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The amount represents around 20% premium to Cerner’s closing share price on December 16.

At the time of writing, Cerner’s shares were trading 19.2% up in the pre-market session on Friday. However, Oracle’s shares were trading 3.8% down.

The report said the deal “could be finalized soon.”

The Cerner acquisition follows Microsoft’s (NASDAQ:MSFT) agreement to acquire Nuance Communication (NASDAQ:NUAN) for $16 billion in April.

About Cerner

Headquartered in Missouri, Cerner provides healthcare information technology services, devices, and hardware. It offers an integrated clinical and financial system to help manage the day-to-day revenue functions of healthcare providers, as well as a wide range of services to support their operational needs.

Wall Street’s Take on the Deal

Commenting on the report, Stifel Nicolaus analyst Brad Reback said, “Should this deal be consummated, it could mark a return to Oracle’s days of aggressive acquisition activity during which time the company very effectively rolled up the legacy client-server application space.”

“What is different this time is that the sector is in the midst of strong secular growth driven by an architectural shift to the cloud while the mid-2000s was ripe for consolidation given the significant number of inefficiently run application vendors that had hit the growth wall,” Reback said in a note to clients.

Last week, the analyst maintained a Hold rating on Oracle and raised the price target from $77 to $87 (15.7% downside potential).

Further, Cowen & Co. analyst Charles Rhyee thinks that the deal makes strategic sense. He said, “We see the greatest opportunity in merging the Oracle Life Sciences business with CERN’s newly launched Enviza operating unit, both of which serve life sciences companies to accelerate drug development. This is a fast-growing and fragmented market.”

“That said, we find the timing of a potential acquisition unexpected, with CERN having just recently appointed Dr. David Feinberg as CEO. Additionally, CERN is currently in the process of executing its strategy of pivoting the company towards higher growth businesses. The company has also been reporting consistent results with continued margin improvements,” Rhyee said in a report.

Analysts’ Recommendation for Oracle

Overall, the stock has a Moderate Buy consensus rating based on 6 Buys and 15 Holds. The average Oracle price target of $103.72 implies 0.5% upside potential. Shares have gained 62.3% over the past year.

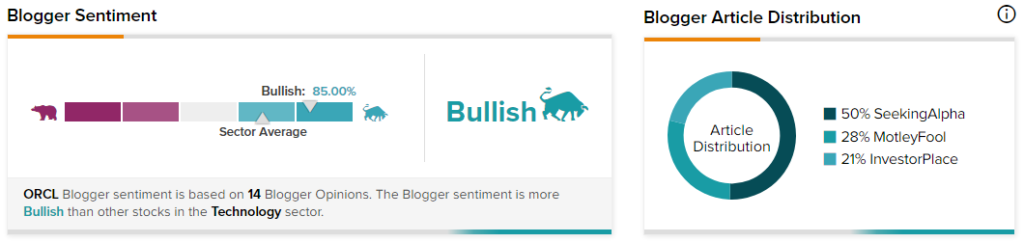

Bloggers’ Opinion

TipRanks data shows that financial blogger opinions are 85% Bullish on the stock, compared to the sector average of 69%.

Price Target for Cerner

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys, 3 Holds and 1 Sell. The average Cerner stock prediction of $82.83 implies 4.2% upside potential. Shares have gained 2.3% year-to-date.

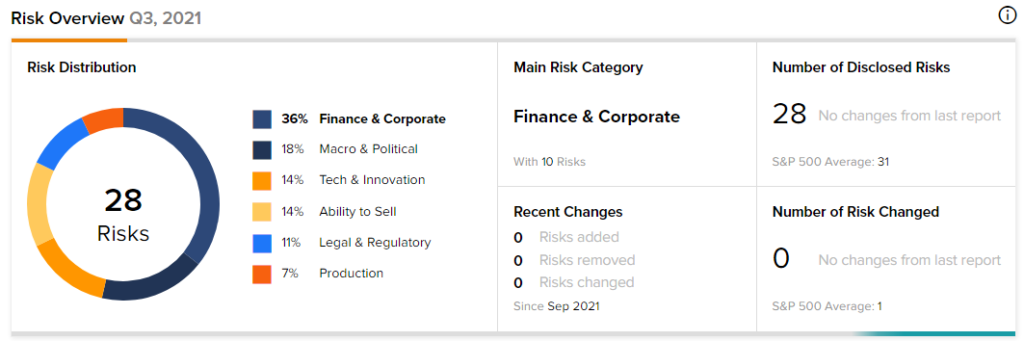

Risk Analysis

According to TipRanks’ Risk Factors tool, Cerner is at risk mainly from one factor: Finance & Corporate, which accounts for 36% of the total 28 risks identified for the stock. Under the Finance & Corporate risk category, the company has 10 risks, details of which can be found on the TipRanks website.

Related News:

Genuine Parts to Acquire Kaman Distribution Group for $1.3B; Shares Rise

U.S. Steel Announces Q4 Expectations; Shares Drop on Order Concerns

CEO of GM’s Cruise Leaves; Shares Fall 2.8%