Could Apple’s (NASDAQ:AAPL) new product release facilitate its next leg of growth? That’s what investors will be hoping the imminent release of the Vision Pro will do.

The tech giant has announced a February 2 release date for its augmented reality (AR) headset. The Vision Pro will go for $3,500, and offers an immersive media experience, its advanced capabilities like eye and hand tracking, enabling users to record and watch three-dimensional content.

Oppenheimer analyst Martin Yang believes that passive media consumption will be the primary use case for the Vision Pro, distinguishing it from the competition, rather than productivity or work-related applications. This aligns well with early tech reviews, which have highlighted media consumption as one of its standout features.

“Such early consensus, if remains true after shipment to a broader user base, will give Vision Pro a meaningful advantage over other mixed reality headsets regarding user engagement,” Yang opined.

As far as a similar user experience goes, rivals are also going to find it very difficult to compete with Apple’s moat. “The amount of custom parts (silicon, optical, structural) in Vision Pro is not possible without Apple’s decades of symbiotic relationships with supply chain partners,” say Yang. Not to mention, the “significant synergies” with existing Apple products.

Additionally, the display capabilities of the Vision Pro have the potential to establish new benchmarks for home theater and linear content, especially as it gains more widespread adoption (i.e., surpasses 2 million units).

There are, however, obvious 1st gen drawbacks such as a pricey entry point and its heavy weight, and similar to the trajectory of the Apple Watch, Yang thinks it will take a few hardware iterations to “optimize its features and capabilities according to real world uses.”

Nevertheless, as consumer tech evolves, Yang views the latest product release as one that will “maintain Apple’s dominant position in consumer hardware.”

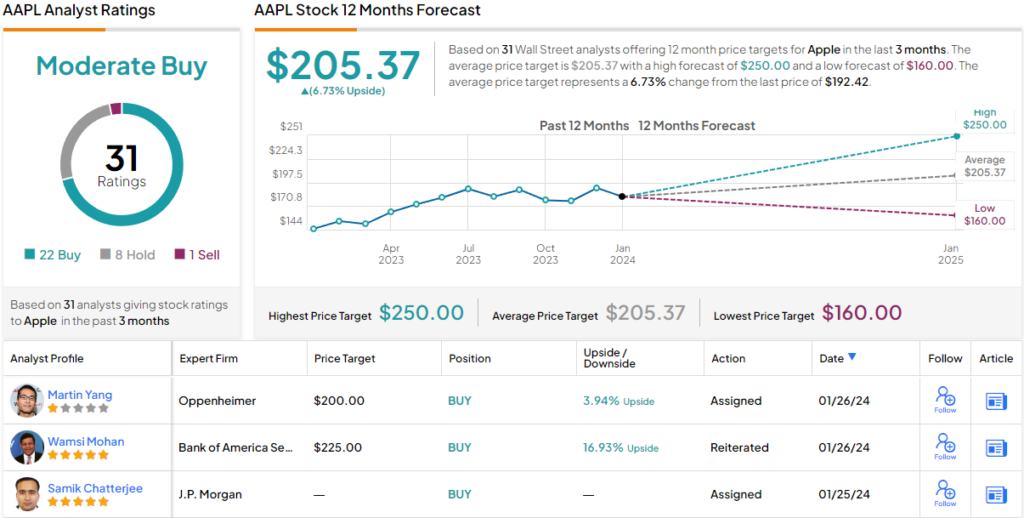

Bottom-line, Yang keeps an Outperform (i.e., Buy) rating on Apple shares, although his $200 price target suggests shares have a modest upside of ~4%. (To watch Yang’s track record, click here)

The Street’s average target is rather similar, and at $205.37, makes room for ~7% from current levels. All in, the stock claims a Moderate Buy consensus rating, based on 22 Buys, 8 Holds and 1 Sell. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.