Microsoft (NASDAQ:MSFT) is seen as a prime beneficiary of AI adoption. After all, it is heavily invested in OpenAI, the brains behind ChatGPT.

However, the path to AI monetization remains unclear. Oppenheimer analyst Timothy Horan notes that so far enterprises have been “slow to adopt AI and associated revenues will likely disappoint.”

Moreover, OpenAI is expected to lose around $5 billion this year, with Microsoft bearing about half of that due to its 49% stake in the company. Meanwhile, as enterprise adoption and infrastructure “remains a bottleneck,” the analyst thinks the Street is probably overestimating near-term AI revenues. “As such,” Horan goes on to say, “we recently reduced our Azure estimates ~100ps on a normalized basis for 2025 going forward.”

Actually, it’s not only AI revenue expectations that are currently being set too high. Horan thinks overall consensus expectations for revenue and EPS are too exuberant.

In FY24 (which ended in the June quarter), gross margins and EBITDA margins both reached records – 69.8% and 58.1%, respectively. Yet, due to higher depreciation and AI-related OpEx, Horan expects both will “tick down.” This will result in only 3% EPS growth in F1Q25, with the analyst anticipating “weakish guidance” for 2025. Additionally, Horan believes consensus EPS growth estimates for FY26 and FY27 are approximately 200 basis points too high.

Then there are the significant investments in GPUs and datacenter capacity causing a sharp rise in CapEx and depreciation expense. Over the next couple of years, much of the CapEx spending is unlikely to generate a return on the investment.

Adding to these concerns, Horan points out a potential shortage of data center capacity to accommodate expected GPU shipments. He also notes that AI competitors have “closed much of the competitive gap advantage it had.”

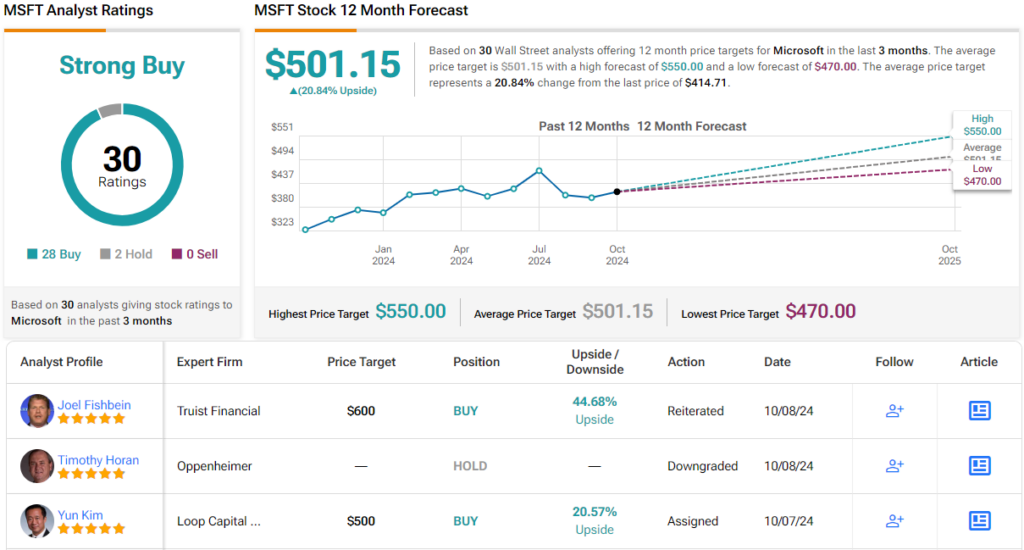

So, down to business, what does this all mean for investors? Horan has now downgraded his MSFT rating from Outperform (i.e., Buy) to Perform (i.e. Neutral) and has taken his prior $500 price target off the table. (To watch Horan’s track record, click here)

That said, looking at the rest of the Street’s take, there is only one other MSFT skeptic joining Horan on the sidelines with all 28 other analysts backing its case, all coalescing to a Strong Buy consensus rating. The average price target currently stands at $501.15, making room for 12-month returns of ~21%. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.