2023 was a lousy year for the semiconductors sector – or as Oppenheimer analyst Rick Schafer puts it, 2023 was a “correction year” for semiconductors. Overall, revenues across the semiconductors sector declined by about 10%. And yet, perversely, this wasn’t necessarily bad news for semiconductor stocks.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

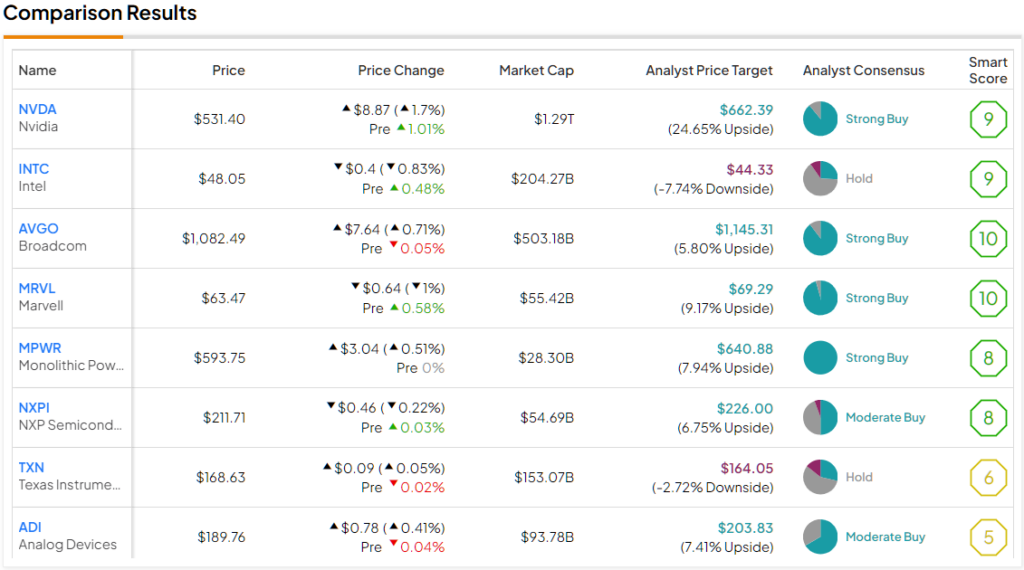

Nvidia (NASDAQ:NVDA) tripled in 2023, after all, and Intel (NASDAQ:INTC) shares rose 3x as fast as the overall S&P 500, and many other semis either met or beat the market benchmark’s performance. Overall, the PHLX Semiconductor index (SOX) gained 67% in 2023 – a surprisingly strong performance in a rather rough year for the business.

Or perhaps… not surprising at all.

As Schafer points out, it’s actually standard operating procedure for investors to look at a down cycle in semiconductors, and anticipate an upcycle in the year to come. Buying this “rumor” rather than selling the actual bad “news,” therefore, investors seem to have piled into semiconductors in 2023, on the theory that 2024 just has to be better.

And newsflash: Schafer thinks 2024 will in fact be better, at least for some flavors of semiconductors, and overall stock price growth in the SOX could be as good as 11%.

The gains may not be immediate, however. As Schafer relates, semiconductor sales began to pick up around October 2023, but global purchasing managers’ indices (PMIs) are still in contraction territory. Graded on a 100-point scale, any number below 50 is considered to indicate contraction. Schafer notes that PMIs in Europe, the U.S., and China are all still below that threshold (although they’re rising in Europe and the U.S., while China’s PMI remains low and is declining). This leads the analyst to believe that growth in semiconductor sales will likely be weighted towards the second half of 2024.

So where do the opportunities lie this year?

Two points may not come as a surprise: According to Schafer, semiconductor demand in both PCs and mobile devices remains weak. For instance, PC sales plummeted by 15% in 2023 following a 17% drop in 2022, with only a modest 3% gain expected in 2024. Meanwhile, semiconductors for mobile devices also exhibited improvement, declining from 11% in 2022 to 10% in 2023, and are projected to improve to a 5% decline this year. Within this segment, Schafer recommends stocks such as Broadcom (NASDAQ:AVGO) and Marvell (NASDAQ:MRVL).

In contrast, the rapid gains in semiconductors for AI and data centers that we saw in 2023 will continue in 2024. Nvidia – “dominant” in 2023 – “remains the top AI play” in 2024, says Schafer. Additional stocks to watch here are Broadcom and Marvell – yes, again – and also Monolithic Power Systems (NASDAQ:MPWR), which the analyst highlights as key to providing power to NVDA/AMD GPUs and INTC/AMD CPUs.

Most interesting of all, though, are Schafer’s comments on chips suppliers for automobiles, and electric vehicles in particular. “EV manufacturers are lowering production/prices as inventories rise,” warns the analyst, which doesn’t sound great for suppliers such as NXP Semiconductors (NASDAQ:NXPI), Texas Instruments (NYSE:TXN), Analog Devices (NASDAQ:ADI) and Monolithic in the near term. Longer term, however, Schafer says that “auto remains one of our favorite long-term verticals with increased semi content.”

In what may be the most important prediction ever to be buried deep within an analyst note where it will never be seen, the analyst places this gem: “We estimate avg. semi content $600/vehicle today with potential to increase by an order of magnitude in the years ahead.”

Translation: Cars today carry an average of $600 worth of semiconductors under the hood. But just wait. In a few years, any EV you buy will require $6,000 worth of semiconductors to build. And that means that if you wait long enough… one day Texas Instruments might be an even bigger winner than Nvidia.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.