On Holding (ONON) has just released its second quarter earnings for 2024, and the numbers are nothing short of impressive. The Swiss sportswear company, known for its sleek running shoes and innovative gear, hit a record high in net sales, crossing CHF 2 billion over the past year. For Q2 2024 alone, net sales soared to CHF 567.7 million—a 27.8% year-over-year increase, or 29.4% when adjusted for constant currency. This robust performance is a testament to On’s effective multi-channel strategy and explosive growth, especially in Asia-Pacific and apparel.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

ONON Sees Earnings Surge & Sales Growth

On’s gross profit margin for Q2 climbed to 59.9%, up from 59.5% in the previous year. This bump in profitability is due to a mix of high full-price sales and reduced freight costs. Net income skyrocketed by 834.3% to CHF 30.8 million, while adjusted EBITDA jumped 44.7% to CHF 90.8 million. As Martin Hoffmann, Co-CEO and CFO, put it, “These moments are only possible thanks to the dedication and passion of the entire On team.”

Furthermore, On’s direct-to-consumer (DTC) sales grew by 28.1% to CHF 209.4 million, and wholesale sales rose by 27.6% to CHF 358.2 million. Regionally, Asia-Pacific led the charge with a 73.7% increase in sales, a reflection of On’s strong market presence and consumer demand in the region.

On’s Future Outlook

Even though the numbers are strong, On is also concentrating on future growth initiatives. Recent highlights include the launch of their groundbreaking LightSpray™ technology and a high-profile partnership with Zendaya. The company also opened its largest retail store yet in Paris, adding to its global footprint.

Looking ahead, On is optimistic about maintaining its growth trajectory. The company expects to achieve at least 30% constant currency growth for the full year, targeting net sales of CHF 2.26 billion. They also aim to sustain a gross profit margin around 60% and an adjusted EBITDA margin of 16.0 – 16.5%.

Is ON Holdings a Good Stock to Buy?

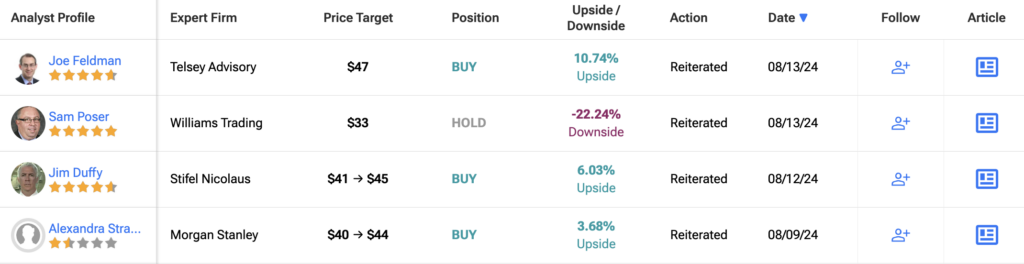

Analysts remain bullish about ONON stock, with a Strong Buy consensus rating based on 15 Buys and one Hold. Over the past year, ONON has increased by more than 20%, and the average ONON price target of $44.33 implies an upside potential of 4.45% from current levels.