Healthcare stocks are not unscathed by the persisting pandemic. Despite an increase in need of pharmacies due to the rapid spread of the Omicron variant in the United States, drugstore chain operators, including CVS Health (NYSE: CVS) and Walgreens Boots Alliance, Inc. (NASDAQ: WBA), have had to shut down some stores due to staffing issues.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

According to Reuters, the recent surge in COVID-19 infections bound the companies to temporarily shut some stores as a staffing shortage has increased.

Notably, to address staffing issues, the drugstore chains, operating altogether nearly 20,000 stores in the U.S., tried using reduction in working hours, raising pay, and hiring tens of thousands more workers as remedial measures, before the Omicron variant was exacerbated.

Companies’ View

CVS Health opined that the temporary store closures on one or both days of the weekend are “to help address acute staffing issues amidst both the Omicron surge and the workforce shortage affecting nearly every industry and company.”

Also, a Walgreens spokesperson said that the recent closures have impacted less than 1% of the company’s around 9,000 stores. “The ongoing labor shortage, combined with the surge of Covid-19 cases, has resulted in isolated instances in which we’ve had to adjust operating hours or temporarily close a limited number of stores,” the spokesperson said.

Markedly, the company is trying to minimize the impact due to the closure of stores by transferring staff from one to another as needed and keeping customers informed at the earliest.

Wall Street’s Take

Recently, Bernstein analyst Lance Wilkes maintained a Buy rating on CVS Health and raised the price target to $116 (9.21% upside potential) from $111.

Consensus among analysts is a Strong Buy based on 20 Buys and 3 Holds. The average CVS Health price target of $114.59 implies 7.88% upside potential. Shares have gained 42.8% over the past year.

Website Traffic

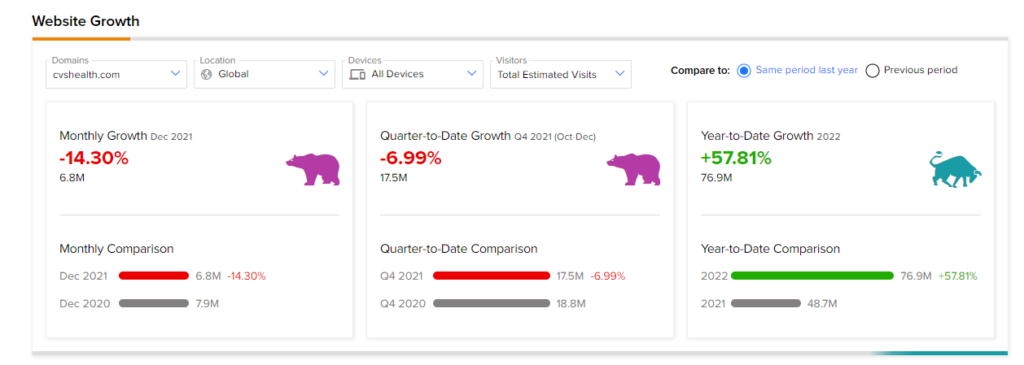

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into CVS Health’s performance this quarter.

According to the tool, the CVS Health website recorded a 14.3% decrease in global visits in December compared to the same period last year. Also, a quarter-to-date comparison showed a fall of 6.99% compared to Q4 2020, while year-to-date website traffic growth stands at 57.81%.

Markedly, we could notice a website traffic uptrend on the website traffic tool. In 4Q21, there was an increase in traffic to the overall CVS Health website from unique visitors, on a global basis. This, in turn, indicates the company might report positive fourth-quarter top-line results as a whole.

Interestingly, CVS Health is also currently among the 50 top trending websites in terms of website traffic in the e-commerce domain.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

ElectroCore Granted FDA Breakthrough Designation for gammaCore nVNS Device; Shares Jump 64%

Delta Rises 2% on Upbeat Q4 Results, Warns of Q1 Loss

Ford’s Market Cap Crosses $100B