Global chemical products provider and ammunition manufacturer Olin Corp. (OLN) has inked an agreement with ASHTA Chemicals to buy and sell chlorine produced at its Ashtabula factory.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Company Vice-President, and President of Chlor Alkali Products & Vinyls, Damian Gumpel, said, “This agreement provides the opportunity to optimize logistics across the Olin and ASHTA portfolio, reducing the number of miles chlorine travels to get to customers and overall transportation costs while increasing the security and flexibility of supply within the growing Olin network.” (See Olin stock chart on TipRanks)

The agreement also enables Ohio-based ASHTA to stay focused on the production of potassium hydroxide, which is its key strength.

On June 23, RBC Capital analyst Arun Viswanathan assigned the stock a Buy rating and increased the target price to $65 (39.8% upside potential) from $63.

Against the present backdrop of higher chlorine and caustic soda prices, Viswanathan believes Olin will pragmatically produce the goods to ensure supply does not outpace demand.

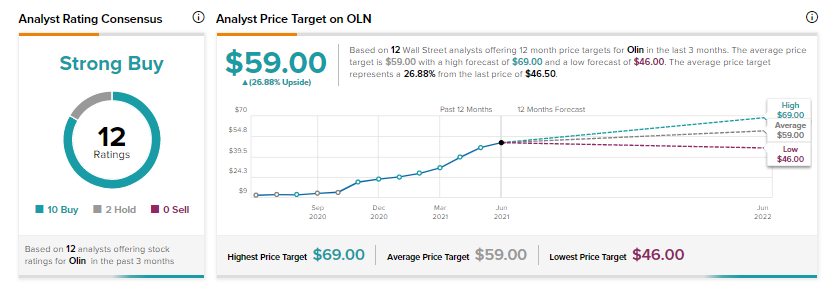

Based on 10 Buys and 2 Holds, consensus on the Street is a Strong Buy. The average Olin price target of $59 implies 26.9% upside potential. Shares have surged 311.5% over the past year.

Related News:

Oasis Declares Special Dividend & Redemption of OMP Common Stock; OAS Shares Jump 4%

WOW! Inks Deals Totaling $1.8B to Sell 5 Service Areas; Stock Hits 52-Week High

Bed Bath & Beyond Reports Better-Than-Expected Revenue, Misses Earnings; Shares Soar 11%