Identity and access management company Okta (NASDAQ:OKTA) delivered better-than-expected Q4 results. Further, the company’s Q1 Fiscal 2025 outlook exceeded Street’s forecast. As a result, Okta stock gained over 23% in Wednesday’s after-hours trading.

Okta Outshines Q4 Estimates

Okta’s total revenue jumped 19% year-over-year to $605 million in Q4, exceeding analysts’ estimate of $587.2 million. Its top line was driven by a 20% growth in its subscription revenue. Okta’s remaining performance obligation (RPO), an indicator of future revenues, increased 13% to $3.385 billion.

The company closed a record number of million-dollar-plus annual recurring revenue (ARR) contracts in Q4. Its customer base with a million-dollar ARR jumped 30%. Further, it added about 150 customers in the fourth quarter.

Thanks to the higher revenues, Okta delivered adjusted EPS of $0.63, up 110% year-over-year. Further, its earnings surpassed the Street’s estimate of $0.51.

Robust Outlook

The company expects to deliver revenue between $603 million and $605 million in Q1 of Fiscal 2025. This compares favorably with analysts’ consensus estimate of $584 million. Further, it projects EPS in the range of $0.54 to $0.55, significantly higher than the Street’s forecast of $0.41.

The company raised its full-year sales outlook. Okta expects its top line to be between $2.495 billion and $2.505 billion in Fiscal 2025. Earlier, it projected revenues to be in the range of $2.46 billion to $2.47 billion. Okta sees full-year EPS to be $2.24 to $2.29, higher than Wall Street’s estimate of $1.96.

Is Okta a Good Stock to Buy Now?

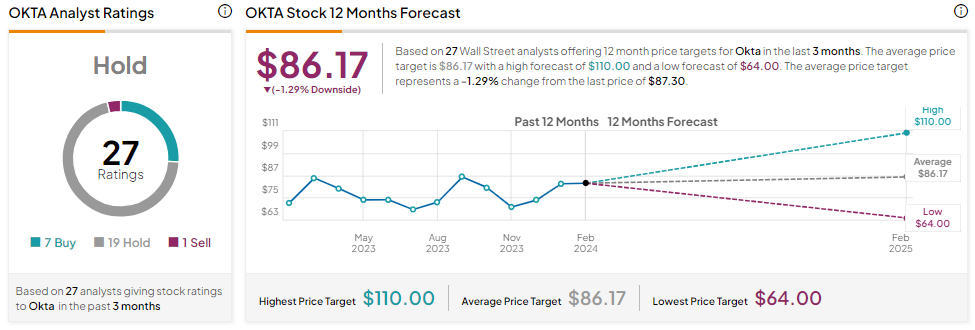

Okta stock is up over 22% in one year. Further, it sports a Hold consensus rating based on seven Buys, 19 Holds, and one recommendation. Analysts’ average price target of $86.17 implies 1.29% downside potential from current levels.

It’s noteworthy that price targets on OKTA stock were set before its solid Q4 earnings release. This raises the possibility that Okta stock might witness upward adjustments in price targets.