The benchmark crude WTI (CM:CL) is up by nearly 1% today after the latest CPI report pointed to easing inflation in the U.S. The lower inflation increases the chances of a rate cut in September.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Inflation, Rate Cuts, and a Weak U.S. Dollar

The combination of easing inflation and lower interest rates could mean potentially higher demand for oil over the coming months. Additionally, weakness in the U.S. dollar is acting as another boost for oil prices as a weak dollar makes dollar-denominated oil more attractive for international buyers.

The latest numbers from the EIA (Energy Information Administration) indicated a decrease of 3.4 million barrels in U.S. crude inventories last week. Similarly, numbers from the American Petroleum Institute (API) pointed to a decline of 1.9 million barrels in U.S. commercial stockpiles for the week ended July 5. The declines continue to point to robust summer travel demand.

The Broader Demand Scenario

While it looks like oil prices could once again test the $85 level, the demand scenario over the coming periods looks far from certain. Oil consumption in China declined in April as well as in May. The International Energy Agency (IEA) expects global demand growth for crude oil to slow down this year. The primary reason for this expectation is the sluggishness in China’s economy.

At the other end of the spectrum, the world is being flooded with new oil supply from the U.S. as well as other regions in the Americas. This is acting, and could continue to act, as a counterweight to production cuts from OPEC+. Consequently, a sustained sharp rally in oil prices looks unlikely.

What Is the Outlook for Oil?

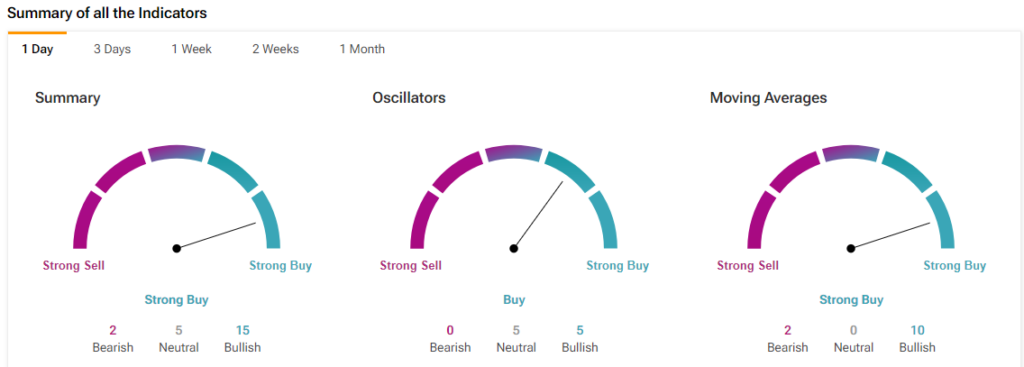

Meanwhile, the TipRanks Technical Analysis tool is flashing a Strong Buy signal for oil on a daily time frame. This means the price action in oil could continue to display strength over the coming sessions.

Ready to “commodi-tize” your knowledge? Click here to dive into the world of commodities on TipRanks

Read full Disclosure