WTI Crude oil finished 0.18% lower at $85.46 per barrel after last week’s rout, as global economic worries continue to dampen sentiment.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Energy producers in the U.S. are not expected to ramp up production while OPEC’s supply cut begins to kick in. Moreover, rising costs could possibly mean a cutback in rigs in the U.S.

In the meantime, U.S. natural fell 7.04% to $5.999 today, as it continued its downward march.

Here are some stocks that could be affected by this news:

- Energy Select Sector SPDR Fund (XLE)

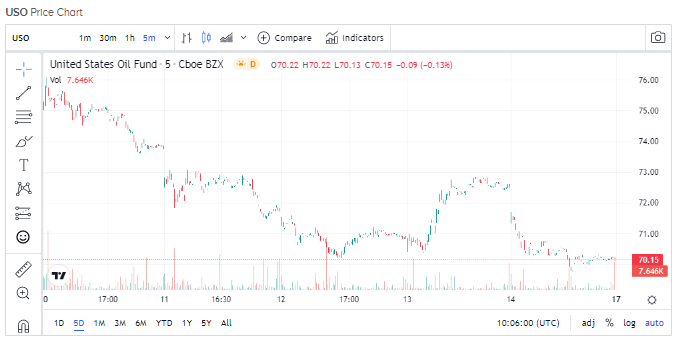

- United States Oil Fund LP (USO)

- ProShares Ultra Bloomberg Crude Oil (UCO)

- Exxon Mobil (XOM)

- Chevron (CVX)

- Occidental Petroleum (OXY)

- United States Natural Gas Fund LP (UNG)

- Cheniere Energy (LNG)

Read full Disclosure