Office Properties Income Trust on Dec. 28 announced the acquisition of a net leased office building for $35.1 million. The 150,000 square feet building has been constructed on 16 acres of land and is located in Fort Mill, SC.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Office Properties Income Trust’s (OPI) acquired property is leased for over 10 years and serves as headquarters for Freedom Mortgage Company subsidiary RoundPoint Mortgage Servicing. The property was built in 2019 and is located along suburban Charlotte, NC.

“The acquisition of this recently constructed, Class A, single tenant, long term leased property in a growing market is indicative of our core investment criteria. We remain committed to continuing the execution of our capital recycling program as we move into 2021,” said Office Properties Income Trust CEO David Blackman.

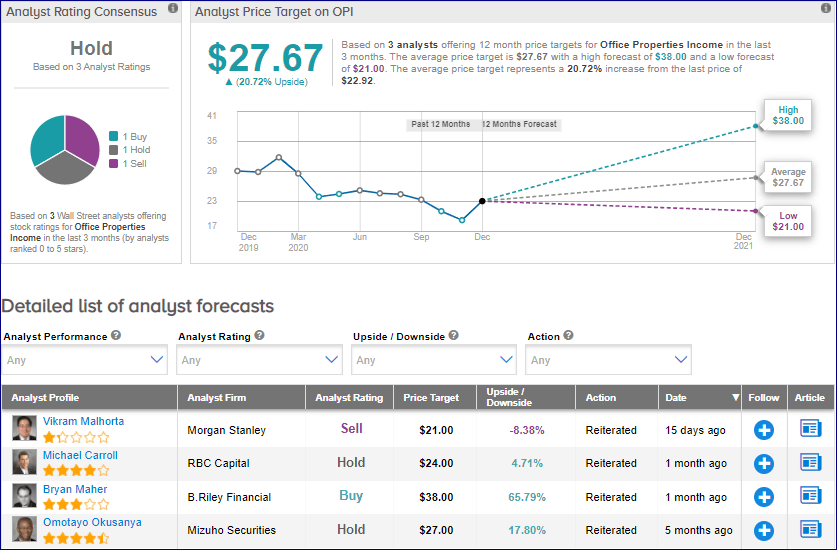

On Dec. 14, Morgan Stanley analyst Vikram Malhorta reiterated a Sell rating on the stock, setting a price target of $21 (8.4% downside potential).

Malhorta expects Office Properties Income Trust to post a net loss per share of $0.08 for Q420. (See OPI stock analysis on TipRanks)

The company reported a net loss per share of $0.08 in Q320.

From the rest of the Street, the stock scores an analyst consensus of a Hold based on 1 Buy, 1 Hold, and 1 Sell. The average analyst price target of $27.67 implies upside potential of 20.7% to current levels. Shares have lost 29% year-to-date.

Related News:

Monday’s Pre-Market: Here’s What You Need To Know Before The Market Opens

AT&T Waives Data Overage Charges After Nashville Service Disruption

Clariant Announces Agenda for AGM; Biggest Shareholder Wants Chairman Out