The October Producer Price Index (PPI) is out; with it, we have a better idea of how inflation affects the U.S. That includes a 0.2% increase in final demand for the month compared to a 0.1% jump in September and a 0.2% rise in August.

Breaking down the increase in final demand for October, readers will notice that most of it is tied to a 0.3% climb in final demand services. Adding to that was a 0.1% growth in final demand for goods.

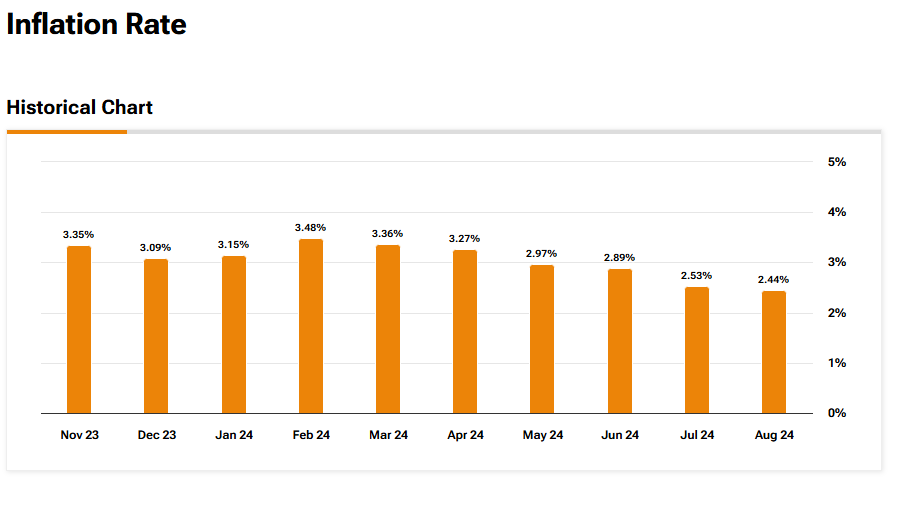

But what about performance on a year-over-year basis? In this instance, final demand saw a 2.4% rise. When excluding volatile items, such as foods, energy, and trade services, final demand experienced a 3.5% surge compared to October 2023.

PPI Report Adds Another Piece to Inflation Puzzle

The October PPI report comes out just one day after the same month’s Consumer Price Index (CPI) report. With both of these reports out, economists have a clearer picture of inflation and its effects on the U.S. economy.

Will The Fed Still Cut Interest Rates?

With all this data out, there are a few concerns that the Federal Reserve will delay plans to reduce interest rates. However, more reports are set to be released before the next Fed decision. That includes the November CPI and PPI and the next Personal Consumption Expenditures (PCE) report, which is coming later this month.

Depending on how the economy looks after these reports are released, the central bank could proceed with cuts or hold off for now. If the latter happens, it would lengthen the time it takes to get interest rates back down to the Fed’s goal of 2%.

For perspective, interest rates are at 4.50% to 4.75% and the Fed typically only makes one 25-point cut at a time. That means it will likely be years before interest rates get back down to a more comfortable level.