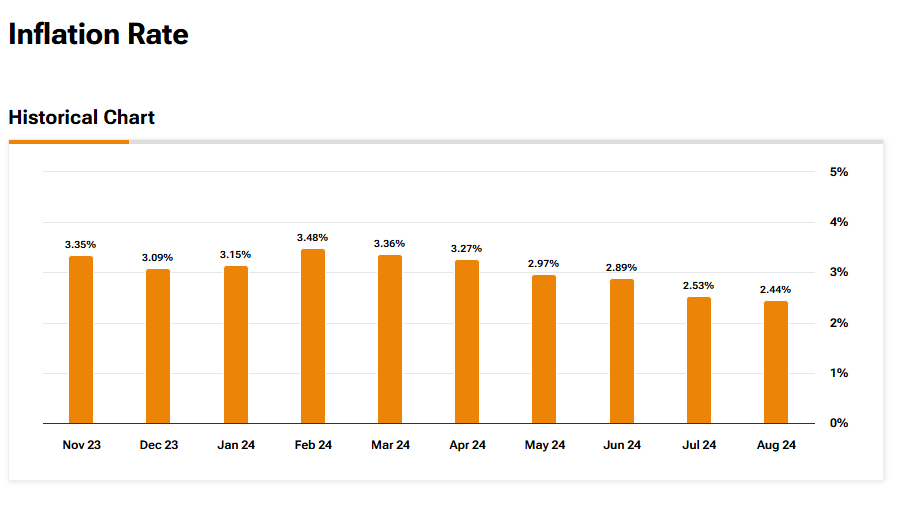

The October Consumer Price Index (CPI) Report is out, bringing the latest details on inflation in the U.S. That includes inflation increasing by 0.2% during the month. For the record, that’s up from the 2.4% reported in September and a 2.6% increase year-over-year. This matches experts’ estimates.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

When looking at the core CPI, which excludes unstable prices such as food and gas, inflation saw a 0.3% increase. August and September saw the same increases. October’s core CPI rose 3.3% compared to October 2023, another match for analysts’ estimates.

Will This Change the Federal Reserve’s Interest Rate Cut Plans?

For now, changes to the Fed’s slow lowering of interest rates remain unchanged. However, there is still time for the central bank to alter course. The next CPI report, as well as the next two Producer Price Index (PPI) reports and the October core Personal Consumption Expenditures (PCE) price index, will be released before the December Fed meeting. Results from these reports could affect its decision concerning interest rates at that meeting.

The Federal Reserve aims to reduce interest rates to 2% after increasing them to combat inflation. It’s still a long road back to that, with rates currently sitting at 4.50% to 4.75% after a 25-point cut during its November meeting last week. Current expectations are for interest rates to drop to 3.75% to 4% by the end of 2025.

How Trump Coming Into Office Could Affect Fed Plans

President-elect Donald Trump is preparing to return to the White House next year following his successful campaign earlier this month. Much of his success came from his campaign’s focus on lowering inflation, a core concern for voters as increased prices weighed on their wallets.

Trump’s plans include increasing tariffs on foreign goods. This has economists split on how this will affect inflation. Many believe that Trump’s tariffs will undo the work done by the Fed to lower prices. Some believe that tariffs will only have a slight effect on inflation and that it won’t be long-lasting.

Fed Chairman Jerome Powell isn’t expecting to change the central bank’s agenda based on Trump winning the Presidency. Even so, he did note that there could be “bumps” in the journey back to 2% interest rates. Whether or not Trump will be behind these bumps remains to be seen.