The future may be looking up for Ocugen (OCGN) stock after the biotech company announced a change in leadership. Ramesh Ramachandran will take over as the company’s new principal financial officer and principal accounting officer.

News of the leadership change brought with it a 2.5% increase for OCGN shares as of Monday morning. Investors will also note that this penny stock is up 61.8% year-to-date and has experienced a 128.93% increase over the last 12 months.

However, keen-eyed investors will notice that OCGN shares have been floundering over the last six months. That’s resulted in the stock falling 51.1% during that period. With that in mind, traders can understand why the company is seeking new leadership.

Why OCGN Investors Should Care

Ocugen announced this financial officer change shortly after releasing its most recent earnings report. Those results left investors unsure about the company’s future. That’s due to widening losses and falling revenue. Even so, it did beat Wall Street’s estimates for the quarter.

Considering its lackluster earnings report, investors are likely hoping for changes to set Ocugen on the path to profitability. Ramachandran leading its finances could help with that.

Ramachandran brings with him years of experience serving in financial leadership positions at other companies, including Tecomet and Lenox Corp. This expertise could be a boon to OCGN investors and help pull the stock out of its recent rut.

Is Ocugen Stock Worth Buying?

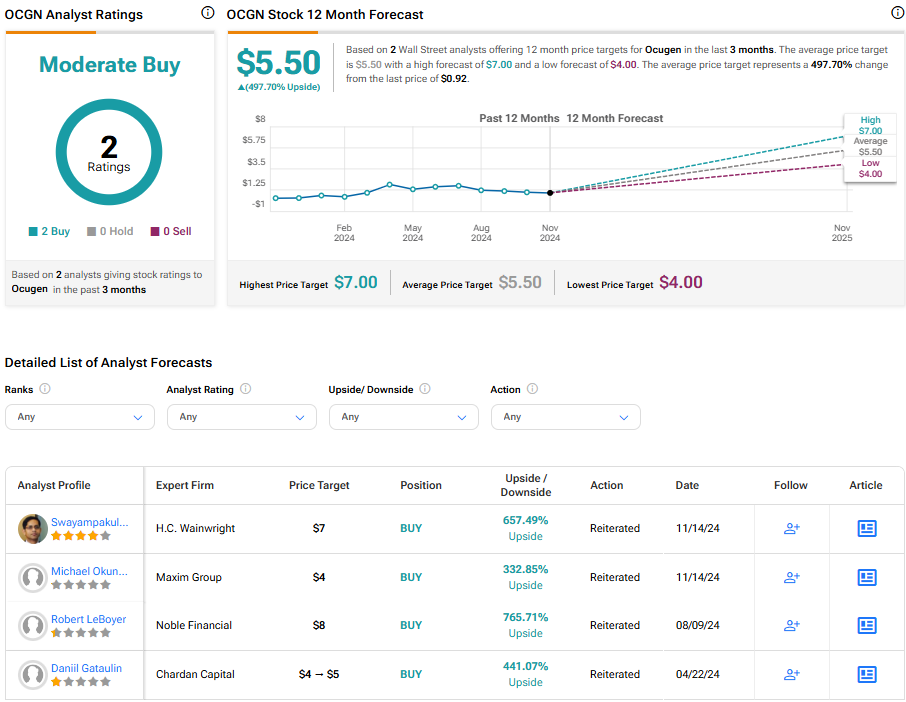

Turning to Wall Street, Ocugen is a Moderate Buy based on two ratings over the last three months. The consensus price prediction for OCGN stock is $5.50, with a high of $7 and a low of $4. This represents a potential upside of 485.98% for the shares.

Questions or Comments about the article? Write to editor@tipranks.com