Shares of Ocugen (OCGN) gained in pre-market trading, even though the company reported disappointing Q3 results. The biotech company’s losses widened in the third quarter to $12.97 million, compared to a loss of $11.7 million in the same period last year.

Furthermore, the company’s revenues plunged by 69.3% year-over-year, reaching $1.14 million in the third quarter, above Street estimates of $400,000.

OCGN Secures $30M Debt Financing

In addition, the company secured debt financing of $30 million through Avenue Venture Opportunities Fund, a fund managed by Avenue Capital Group. This debt financing is intended to support the company’s general corporate needs, including capital expenditures, working capital, and general administrative expenses.

This credit facility, with a term of four years, provided $30 million in fully funded proceeds on the closing date. Along with this debt financing and a $35 million equity financing in the third quarter, the company’s cash runway now extends into the first quarter of FY26.

Is OCGN Stock a Good Buy?

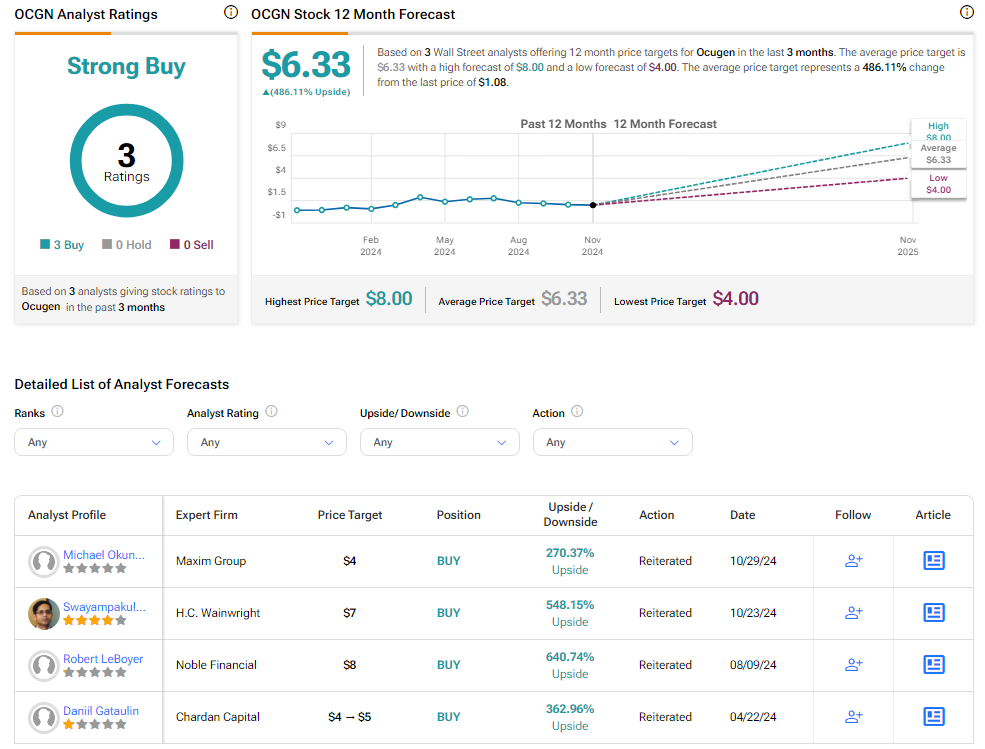

Analysts remain bullish about OCGN stock, with a Strong Buy consensus rating based on a unanimous three Buys. Over the past year, OCGN has increased by more than 100%, and the average OCGN price target of $6.33 implies an upside potential of 486.11% from current levels. These analyst ratings are likely to change following OCGN’s results today.