Warren Buffett’s favorite oil and gas pick for 2022 has turned many heads with its latest results, and seems to have paid off for Buffett, as well. Occidental Petroleum (NYSE: OXY) posted second-quarter earnings of $3.16 per share, outpacing analyst estimates by 13 cents and much better than Q2FY21’s earnings of $2.12 per share. Furthermore, the company even paid back $4.8 billion of debt and activated its share buyback program in the quarter.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Happy with the progress on debt reduction, President and CEO, Vicki Hollub, said, “Our ongoing efforts to improve the balance sheet remain in place, but we are pleased that our deleveraging progress has reached a stage where our focus can expand to additional cash flow priorities.”

OXY’s Q2 Results Bolstered by High Oil Prices

Occidental’s total net sales of $10.68 billion jumped a whopping 79.2% year-over-year, backed by high oil and gas prices and higher volumes. Notably, the oil and gas segment’s average global production reached 1,147 thousand barrels of oil equivalent per day (Mboed) in the quarter, meeting the mid-point guidance.

Additionally, average worldwide realized crude oil prices jumped nearly 17% from the prior quarter to $107.72 per barrel. Meanwhile, average worldwide realized natural gas liquids (NGL) prices rose nearly 6 % from the prior quarter to $42.04 per barrel.

Notably, Occidental repurchased over 18 million shares worth $1.1 billion up to August 1. Plus, the company also pays a decent dividend of $0.13 per share, which could increase in the future depending on the company’s strategy to increase shareholder returns.

Berkshire’s Investment in OXY is Paying Off

Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has been accumulating OXY stock for quite some time now. As per the latest filings, BRK owns nearly 20% stake in Occidental. Additionally, it has around $10 billion of Occidental’s preferred stock, as well as warrants to purchase 83.9 million shares of common stock at $59.62 per share.

The Oracle of Omaha’s bet on the energy major has surely paid off. Any further reduction in outstanding stock through share repurchases might automatically trigger the 20% minimum requirement needed to start the consolidation of a part of the company’s financials.

Moreover, as per Barron’s report, Occidental may also have to start paying Berkshire preferred share dividends in 2023 if its common stock dividend exceeds $4 per share annually.

Analysts Remain Cautious about OXY Stock

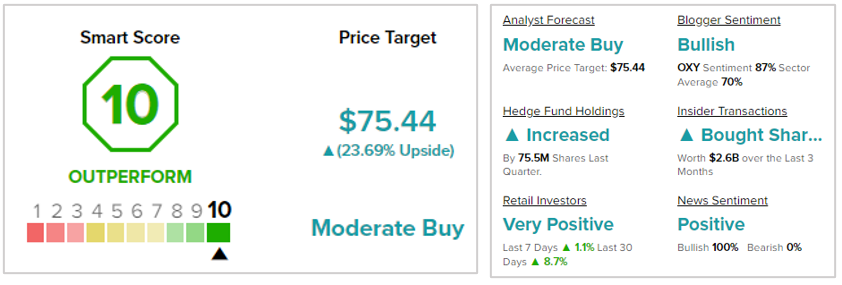

Despite all the good news, analysts remain cautiously optimistic about the stock with a Moderate Buy consensus rating based on seven Buys, seven Holds, and two Sells. The average Occidental Petroleum price target of $75.44 implies 23.7% upside potential to current levels. Meanwhile, the stock has zoomed 97.2% so far this year.

Occidental Scores a Perfect 10

According to TipRanks’ Smart Score, Occidental Petroleum scores a Perfect 10, indicating that the stock is most likely to outperform the market. Bloggers and news articles are bullish on the stock, and hedge funds have increased their holdings of OXY stock by 75.5 million shares in the last quarter. Furthermore, retail investors have increased their exposure to OXY stock by 8.7% in the last 30 days.

Ending Thoughts

Occidental Petroleum is proving to be a very lucrative bet in the oil and gas sector. With all the parameters working in favor of OXY stock, and even after nearly doubling in value this year, analysts still see decent upside potential for the stock. Remarkably, Warren Buffett’s investment strategies seldom go wrong, and investors can still take the opportunity and look for near-term gains in the stock.