Shares of NXP Semiconductors rose 3.1% in extended trading on Monday, after the company’s 4Q revenue guidance topped analysts’ estimates. The semiconductor giant forecasts 4Q revenues in the range of $2.375-2.525 billion, higher than the consensus estimate of $2.27 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Moreover, NXP’s (NXPI) 3Q revenues increased 1% year-over-year to of $2.3 billion and came ahead of the consensus estimate of $2.23 billion. However, NXP reported a 3Q loss of $0.08 per share, while analysts had expected earnings of $1.53 per share. In the year-ago quarter, the company posted earnings of $0.38.

NXP CEO Kurt Sievers said “Consistent with our pre-announcement on October 8, our third-quarter results were significantly better than our original guidance, reflecting a strong rebound in demand across nearly all of our focus end markets.”

Sievers added that “the momentum which began during the third quarter is continuing into the fourth quarter of 2020. Within our strategic end markets of Automotive, Industrial & IoT and Mobile the improving trends are due to a combination of a rebound in our core business, as well as solid contribution from the ramp of new products. The recovering markets along with our strong product portfolio and customer engagements make us confident to continue to deliver robust growth in 2021.” (See NXPI stock analysis on TipRanks).

The company projects its gross margin in the range of 50.9%-51.6% and operating margin in the range of 17.9%-19.8% for the fourth quarter.

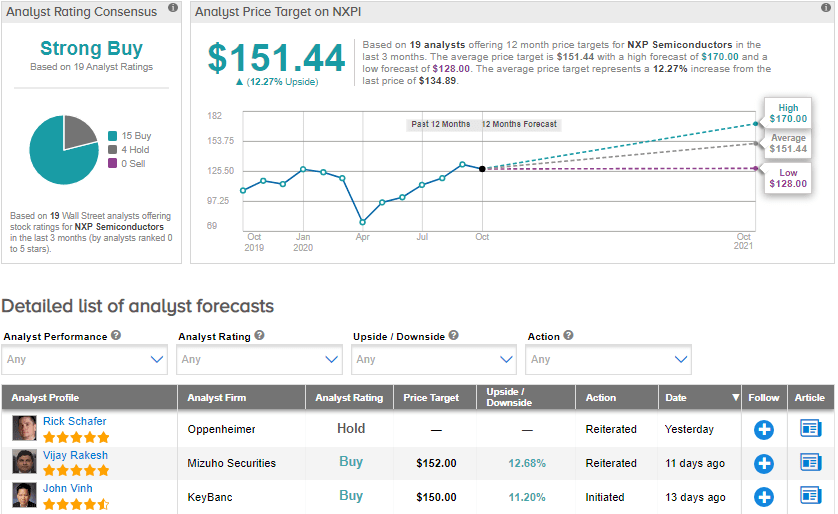

Following the results, Mizuho Securities analyst Vijay Rakesh maintained a Buy rating and a price target of $152 (12.7% upside potential). Rakesh believes the 4Q guidance will be driven by Automotive and Mobile businesses. The analyst said that the mobile business “could continue to drive strength into 4Q20 with the iPhone 12 launch complemented by a continued Auto recovery.”

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 15 Buys and 4 Holds. The average price target of $151.44 implies upside potential of about 12.3% to current levels. Shares have advanced 6% year-to-date.

Related News:

NXP Semi Pops 5% On Q3 Guidance Boost; Analyst Says Hold

Intel Sinks 9% As 3Q Data-Center Sales Disappoint

AMD Could Ink $30B Xilinx Deal As Soon As Next Week- Report