Shares of Media conglomerate News Corp. (NWSA) (NWS) popped almost 4% in Friday’s pre-market trading, as the company reported a healthy fourth-quarter beat. Investors also cheered the news that management is considering selling the company’s Australian pay TV platform, Foxtel.

News Corp.’s revenues rose 6.2% year-over-year to $2.58 billion in Q4 FY24 (ended June 30, 2024), outpacing estimates of $2.49 billion. At the same time, adjusted earnings per share (EPS) jumped 21.4% to $0.17 and came in better than the consensus of $0.16.

NWSA Segments Deliver Impressive Growth

The Rupert Murdoch-founded company witnessed solid growth across most of its segments. Sales from REA Group, the company’s Australian real estate ad services business and a major contributor to its Digital Real Estate Services segment, jumped 37% year-over-year. Similarly, News Corp.’s Book Publishing segment, which includes HarperCollins, grew 15% compared to Q4 FY23.

Meanwhile, revenues from the company’s Subscription Video Services segment (Foxtel Group) and Dow Jones segment (The Wall Street Journal and Barron’s) increased by 1% and 4%, respectively. The only negative performer was the News Media segment (News Corp Australia and New York Post), which reported a 5% year-over-year drop in revenues owing to falling advertising, circulation, and subscription revenues. As seen in the chart below, the News Media division is a key revenue contributor for the company.

News Corp. Could Put Foxtel for Sale

News Corp. is taking several strategic measures to maximize shareholder value and ensure long-term growth prospects for the media house. After witnessing third-party interest, the company is considering selling its Australian pay TV and streaming services business, Foxtel Group. The talks are in very early stages and there is no certainty of a sale.

The Foxtel Group saw steady growth in its paying streaming subscribers to 4.7 million as of June 30. This was backed by solid subscriber additions in both Kayo and BINGE streaming services.

As part of another strategic tie-up, News Corp. has struck a multi-year deal with ChatGPT-maker, OpenAI. The deal gives OpenAI access to all of News Corp.’s current and archived content. At the same time, NWSA is taking all necessary steps to prohibit AI aggressors from illegally confiscating its content.

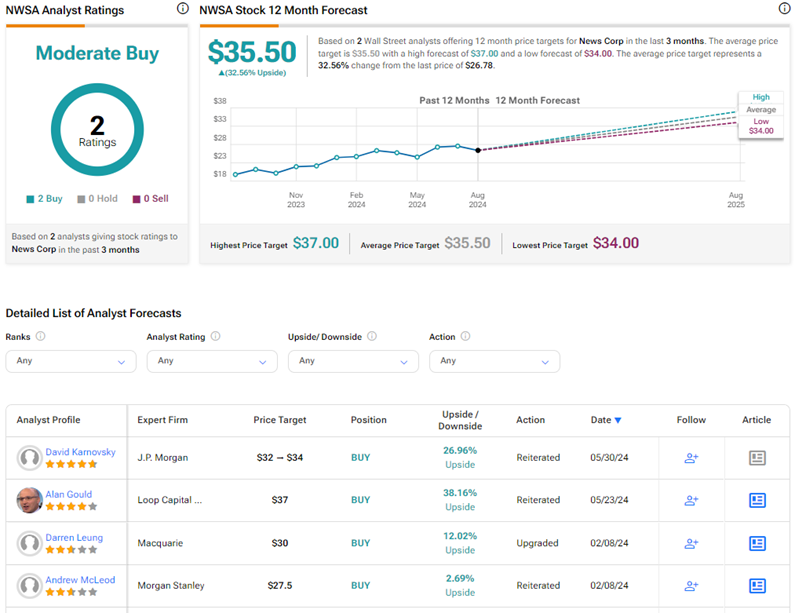

What is the Price Target for NWSA?

On TipRanks, the average News Corp. price target of $35.50 implies 32.6% upside potential from current levels. Shares have gained 9.5% year-to-date. NWSA stock has a Moderate Buy consensus rating based on two Buys. These ratings are subject to change as analysts could revisit their recommendations following the Q4 print.