Research firm Mizuho Securities’ Managing Director Jordan Klein says that chip giant Nvidia’s (NVDA) stock price could reach $160-$170 in the first quarter of calendar year 2025. The target range reflects a 14.8% to 22% upside potential from current trading levels.

Klein pointed out several catalysts for the share price jump after multiple investor discussions, debates, and ideas for 2025. He came back confident that Nvidia’s positioning remains rock solid in the GPU (graphics processing unit) market and the AI (artificial intelligence) sphere. Let’s understand the three main catalysts in detail.

- CES Event in January – Investors expect Nvidia’s management to reinforce its bullish outlook at the CES (Consumer Electronics Show) event set between January 6-10. Importantly, investors and analysts await more details about its most advanced architecture Rubin, which is based on Taiwan Semi’s (TSM) 3nm process technology, enabling higher performance and energy efficiency.

- Q2 FY25 Earnings in February – Klein noted that he sees cloud hyperscalers such as Nvidia report more beats and raises in 2025. Nvidia’s Q2 FY25 results are scheduled to be announced on February 26, 2025. The semiconductor giant has exceeded expectations for eight consecutive quarters and might continue to do so. Furthermore, with Nvidia’s Blackwell products going into mass markets, revenues are expected to show a big boost.

- GPU Trading Conference (GTC) in March – Nvidia’s GTC is scheduled between March 17 to 20, next year. The conference brings together thousands of developers, innovators, and business leaders to explore real-world applications of generative AI and accelerated computing. During the run-up to the conference, NVDA’s stock price usually rises, making Klein more bullish on the price target.

Overall, among the players in the semiconductor and hardware sector, Klein remains most bullish about Nvidia stock’s trajectory into the first half of 2025. He thinks that the three main catalysts highlighted above could push up NVDA’s stock price to the range of $160-$170 in the March quarter.

Is NVDA a Good Buy Right Now?

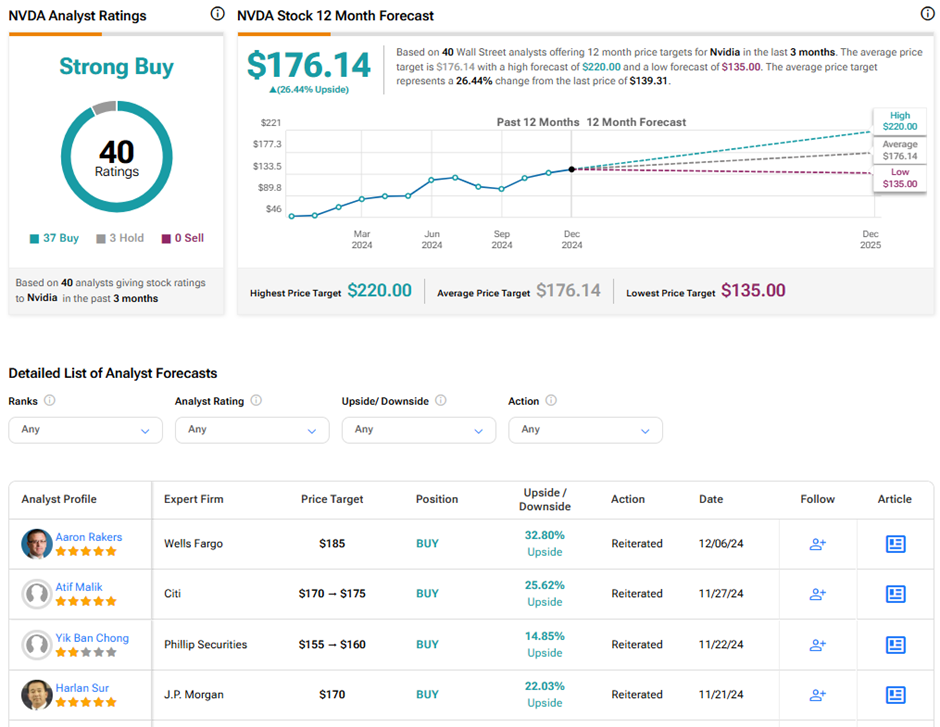

Wall Street remains highly optimistic about Nvidia stock. Analysts are encouraged by Nvidia’s innovative product roadmap, ever-increasing product demand, strong market positioning, and solid financial health.

On TipRanks, NVDA stock commands a Strong Buy consensus rating based on 37 Buys and three Hold ratings. Also, the average Nvidia price target of $176.14 implies 26.4% upside potential from current levels. Meanwhile, Nvidia shares have zoomed 181.4% so far this year.