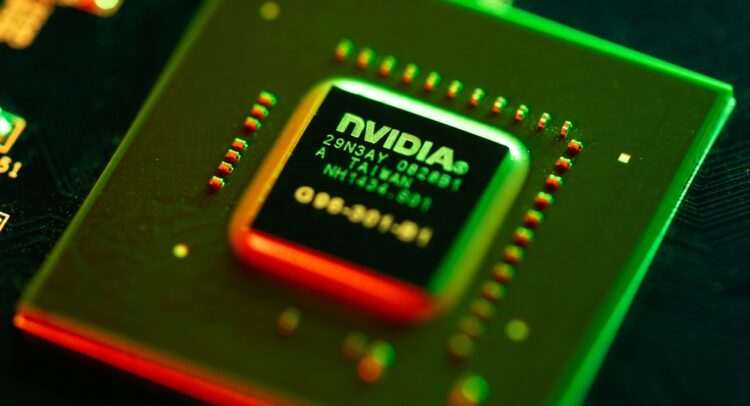

Chip giant Nvidia (NASDAQ:NVDA) will begin the mass production of its H20 AI chip in the second quarter of this year, according to a Reuters report. The H20 chip is apparently the most powerful of the three versions Nvidia is developing for the Chinese market. The firm is developing these products to bypass the enhanced export restrictions on advanced chips by the U.S. Department of Commerce.

The launch of this chip was originally scheduled for last year, but that plan was delayed because the server manufacturers were having issues integrating the chip. The initial production will likely be limited as the company will focus on fulfilling orders for major customers.

However, another Wall Street Journal report states that Chinese cloud companies are rejecting Nvidia’s chips.

What is the Target Price for NVDA?

Analysts are bullish about NVDA stock, with a Strong Buy consensus rating based on 31 Buys and four Holds. Over the past year, NVDA stock has surged by more than 200%, and the average NVDA price target of $660.77 implies an upside potential of 34.6% at current levels.