Nvidia’s (NVDA) advanced AI chips seem to be making their way to China despite U.S. export restrictions. According to an exclusive Financial Times report, several smaller Chinese cloud providers charge local tech companies around $6 per hour to access a server equipped with eight Nvidia A100 processors in a basic configuration. Meanwhile, smaller cloud vendors in the U.S. charge around $10 per hour for the same setup.

Adding to the complexity, Nvidia’s A100 and H100 chips are openly sold on Chinese social media, e-commerce platforms like Xiaohongshu and Taobao, and in electronics markets, albeit with slight price markups compared to abroad.

Why Are Nvidia’s Chips Critical to AI?

To understand why these chips are so sought after, it’s important to note that Nvidia’s AI chips, the A100 and H100, are used to train large language models for AI applications. The company has been banned from shipping the A100 to China since 2022 and has never been permitted to sell the H100 there.

China’s Large Cloud Operators also Provide Access to These Chips

Interestingly, China’s larger cloud operators, such as Alibaba (BABA) and ByteDance, charge significantly higher prices than smaller local vendors for Nvidia A100 servers. According to pricing from both companies and feedback from customers, these larger providers charge two to four times more for similar server setups.

However, it is worth noting that after applying discounts, both Alibaba and ByteDance offer packages at rates that are competitive with Amazon Web Services (AMZN), which charges between $15 and $32 per hour for similar services.

Nvidia’s Response to Its AI Chips Being Available in China

In response to these developments, Nvidia stated that it primarily sells its processors to “well-known partners… who work with us to ensure all sales comply with U.S. export control rules.” The company also noted that its pre-owned products are available through various second-hand channels. While Nvidia cannot track its products after they are sold, it emphasized that “if we determine any customer is violating U.S. export controls, we will take appropriate action.”

Is Nvidia a Buy, Sell, or Hold?

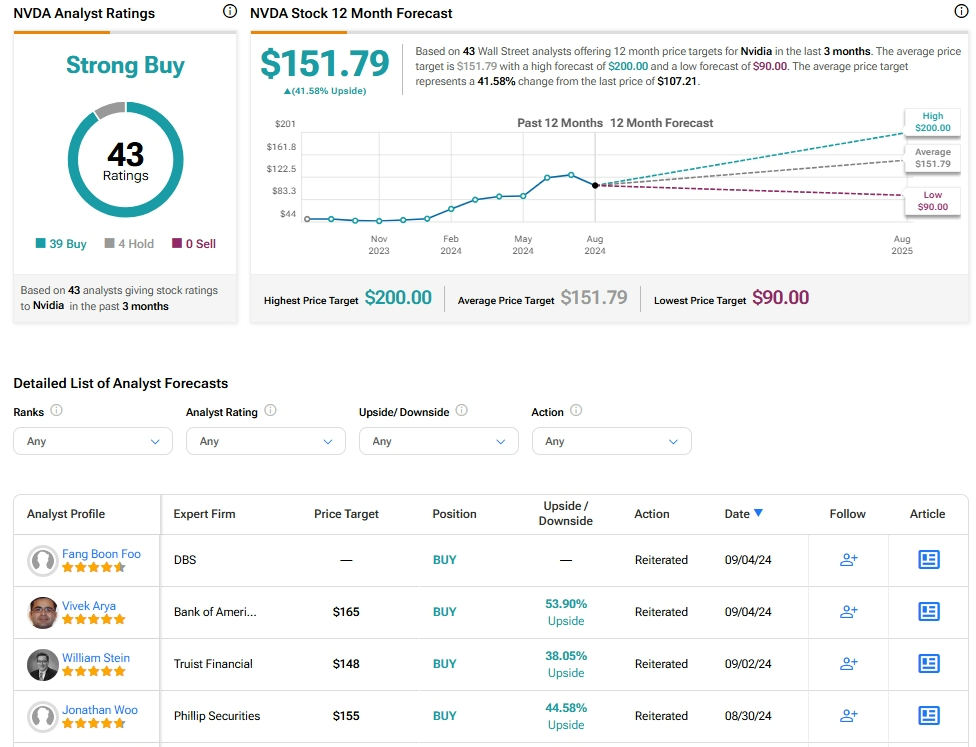

Analysts remain bullish about NVDA stock, with a Strong Buy consensus rating based on 39 Buys and four Holds. Over the past year, NVDA has skyrocketed by more than 100%, and the average NVDA price target of $151.79 implies an upside potential of 41.6% from current levels.