It might not be the first thing that comes to mind when you think of Nvidia (NASDAQ:NVDA), but the chip giant’s Healthcare business is a substantial one.

Boosted by the growing computational demand for AI – drug discovery, genomics, patient diagnostics, medical devices and robotics –Nvidia’s Healthcare vertical is by now a $1 billion-plus business, having reached that milestone 2-3 years ahead of expectations.

According to J.P. Morgan’s Harlan Sur, a 5-star analyst rated in the top 1% of the Street’s stock pros, Nvidia’s Healthcare vertical ranks among the top 3 segments within the company’s datacenter business.

“NVIDIA’s ability to drive accelerated computational solutions through its HPC and AI/DL platforms continue to drive significant revenue opportunity for the firm,” Harlan opined. “Moreover, the team continues to see strong market expansion potential driven by opportunities in wearables, medical/imaging/robotics, and computer-aided drug discovery.”

These insights follow a presentation by Kimberly Powell, Nvidia’s VP of Healthcare, at J.P. Morgan’s 42nd annual Healthcare Conference. The feeling at Nvidia is that, boosted by generative AI and the growing opportunity in computer-aided drug discovery, the Healthcare segment is now “at an inflection point.”

The software framework utilized in computer-aided chip design has been a driving force behind the trillion-dollar electronics sector and Nvidia sees a similar trend emerging in drug discovery, anticipating a significant boost in computer-aided drug discovery. Considering the annual $250 billion spent on R&D in healthcare, there’s a big opportunity at play, then.

As companies in pharma/biotech, healthcare/clinical, and academia are leveraging Large Language Models (LLMs) or transformer-based models to address various challenges, generative AI is having a significant impact on the healthcare industry. Nvidia has a presence here via BioNeMo, a generative AI platform that offers services for the creation and deployment of tailored AI foundation models specifically designed for drug discovery. The platform is now being advanced into its beta phase.

The software stack/ecosystem is also bolstered by three announcements which Sur thinks “further strengthen their competitive positioning.” First, the team is expanding its collaboration with Amgen, with the aim of developing generative AI models for gaining insights from human data and enhancing drug discovery, all facilitated by Nvidia’s DGX SuperPOD. Second, the company has revealed Recursion as their inaugural partner to utilize their foundational model, Phenom Beta, within the BioNeMo framework. Lastly, Nvidia has also announced its own foundational model, MoIMIM.

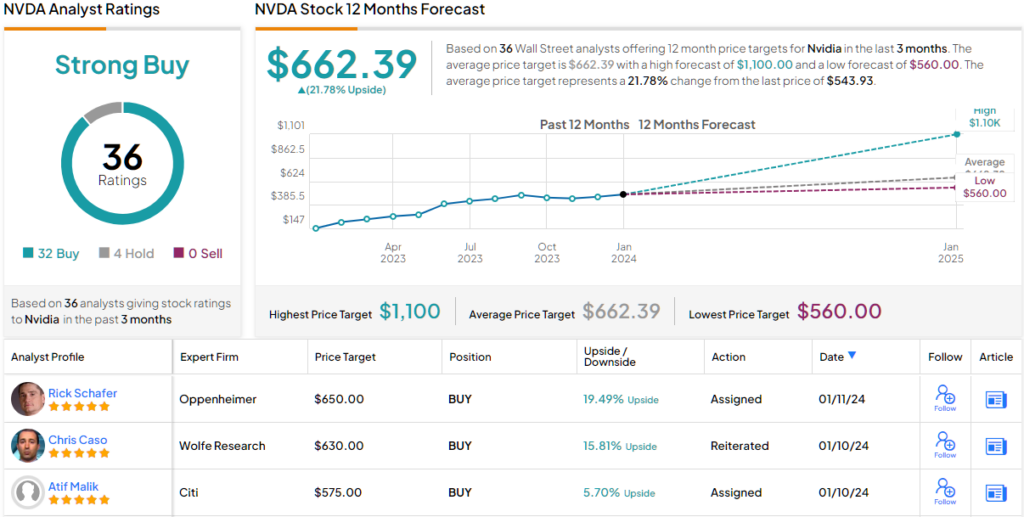

So, good news for Nvidia, but what does it all mean for investors? Sur reiterated an Overweight (i.e., Buy) rating on Nvidia shares to go alongside a $650 price target. Should the target price be met, investors could potentially earn a return of 22% in a year. (To watch Sur’s track record, click here)

On Wall Street, 31 other analysts join Sur in the bull camp, easily outnumbering the 4 skeptics and resulting in a Strong Buy consensus rating. At $662.39, the average target factors in 12-month gains of 23%. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.