With revenues across semiconductor companies trending down by 10% last year, 2023 amounted to a correction period for the group. However, you wouldn’t really know that from the segment’s overall performance, as acknowledged by Oppenheimer analyst Rick Schafer.

“In classic fashion,” says the 5-star analyst, “investors began discounting fundamental trough early, propelling the SOX 67% higher in 2023. The best growth stories outperformed.”

Those growth stories were based on catching a ride on the year’s major theme – AI. Names that had high exposure to the space benefited immensely with Nvidia (NASDAQ:NVDA) leading the pack and its rival Advanced Micro Devices (NASDAQ:AMD) also enjoying the year’s market spoils – both stocks delivered big returns for investors.

Looking ahead to 2024, as companies push to monetize their AI strategies, AI remains Schafer’s top theme for the year, so can we expect more outperformance from these chip giants? Schafer has been assessing their prospects, and out of the pair, thinks one is better positioned than the other, so let’s take a deep dive and find out which one that is.

Nvidia

For those following stock market trends, it has been hard to avoid the rise and rise of Nvidia over the past year. Not that the semiconductor firm was an obscure minnow a year ago, but the stock’s success – up by 239% throughout the year – has propelled its market cap to the exclusive environs of the $1 trillion-plus club.

There’s a pretty straightforward explanation for that success. Where once Nvidia was primarily a graphics company building chips to be used in gaming, its secondary data center business has now become its main breadwinner. The company has practically cornered the market with its industry-leading AI chips. And thankfully for Nvidia, demand has gone through the roof.

The result has been a series of earnings reports that sent jaws dropping across Wall Street. A read through the chip giant’s fiscal third quarter statement illustrates its strength. Data Center revenue climbed by 279% year-over-year to reach a record-setting $14.51 billion, as total revenue came to $18.12 billion, improving by 205.6% on the same period a year ago. That figure also beat the consensus estimate by $2.01 billion. It was a similar story at the other end of the spectrum as adjusted net income soared by almost 600% y/y to $1.46 billion, resulting in adjusted EPS of $4.02, outpacing Street expectations by $0.63. As for the guidance, for FQ4, Nvidia expects revenue will hit $20 billion, plus or minus 2%, suggesting a y/y increase of almost 231%. The analysts were looking for just $17.82 billion.

Meanwhile, the stock has transitioned seamlessly to the new year, still piling on the gains despite a muted performance so far from the rest of the segment.

For Schafer, that’s not much of a surprise, given he sees Nvidia as an ongoing winner against a backdrop of AI adoption. “Up 10% YTD (SOX -3%) NVDA trades 23x our CY25E EPS vs. three-year average 38x,” notes the analyst. “NVDA remains the purest scale play on AI proliferation. Sustained structural growth led by DC AI as accelerator attach increases (could hit 40–50% in cloud within five years vs. 20% today). NVDA’s entrenched DC/AI ecosystem is core to GenAI adoption. We remain long-term buyers… Nvidia remains one of our top picks for 2024.”

To this end, Schafer rates NVDA as Outperform (i.e., Buy) while his $650 price target makes room for further gains of ~19% from current levels. (To watch Schafer’s track record, click here)

Most analysts are thinking along the same lines. Based on a mix of 31 Buys against just 4 Holds, the stock claims a Strong Buy consensus rating. Going by the $662 average target, a year from now, shares will be changing hands for a 21% premium. (See Nvidia stock forecast)

Advanced Micro Devices

It’s only fitting that a look at Nvidia should be followed by assessing AMD’s prospects. In the AI game, the company is seen as one that could yet eat away at Nvidia’s dominance by bringing products to market that are equal in quality and have their own advantages in the form of open-source software versus Nvidia’s proprietary solutions while also boasting cheaper price points.

History also shows that AMD has been able to rein in a segment leader before. Once completely overshadowed in the CPU space by chip colossus Intel, over the years, AMD has steadily chipped away at its supremacy, transforming under the guidance of CEO Lisa Su from a company on the precipice of bankruptcy around a decade ago to a semi-giant with a market cap of ~$236.7 billion.

Like Nvidia, AMD majorly outperformed last year, delivering returns of 127%. While not nearly as stunning as Nvidia’s financial statements, the company also delivered generally strong quarterly readouts, concluding with beats in the Q3 print.

In the quarter, revenue grew by 4.1% on a year-over-year basis, reaching $5.8 billion and outpacing analyst expectations by $110 million. At the bottom line, adjusted EPS of $0.70 represented a $0.02 beat over the Street’s forecast. However, the Q3 print was not an all-out success, primarily due to a disappointing outlook. For Q4, the company sees revenue reaching around $6.1 billion, plus or minus $300 million versus consensus at $6.39 billion.

While AMD can be applauded for managing to constantly keep its rivals on their toes, for Schafer, the combination of strong competition and a lofty valuation is just too much for him to get on board.

“We remain cautious toward AMD’s ability to deliver a profitable long-term business model as the second horse in the secularly declining PC market. We see financially and technologically stronger NVDA and market-leading INTC strengthening their positions in both CPU and GPU, challenging AMD’s revenue and GM trajectory. We believe chasing substantially lower GM gaming business further hinders the company’s ability to improve profitability. The business model has structural problems, and with valuation above peers, we view risk/reward as balanced here,” Schafer opined.

To this end, Schafer continues to monitor AMD’s progress from the sidelines with a Perform (i.e., Neutral) rating and without a fixed price target.

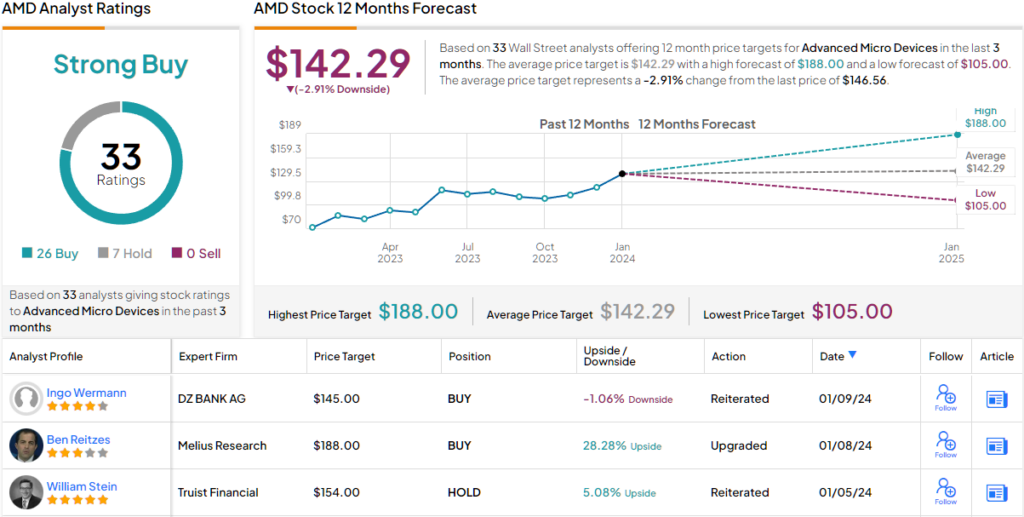

That said, Schafer belongs to a minority on Wall Street. Elsewhere, the stock claims an additional 26 Buys and 6 Holds, all coalescing to a Strong Buy consensus rating. That rating, though, can be considered a tad deceiving, as the $142.29 average target suggests the shares will stay rangebound for the time being. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.