Nvidia (NVDA) shares are falling at the time of writing as investors begin to grow worried that the AI-driven spending that fueled Nvidia’s rise may soon slow down or shift to rivals. This is due to concerns about delays with its new Blackwell servers. In addition, slowing AI investments by Microsoft (MSFT) and Google (GOOGL) are not helping either.

Adding to Nvidia’s current list of problems, China recently launched an antitrust probe into its $7 billion acquisition of Mellanox, which is creating more uncertainty. At the same time, competition is ramping up, with Amazon (AMZN) building a supercomputer using its Trainium AI chips and Broadcom (AVGO) reporting major deals to supply custom XPUs.

Nevertheless, AI infrastructure spending is still massive, with Microsoft, Meta (META), and Google reporting significant capital expenditure increases. However, growth may be slowing down, with JPMorgan estimating AI spending by hyperscalers will rise by 30% in 2025, which is down from the 57% seen in 2024. Interestingly, the investment firm noted that 2024 likely marked the peak growth rate for Nvidia.

New Jetson Computer for AI Applications

In a separate development, Nvidia introduced a new $249 version of its Jetson computer for AI applications to attract hobbyists, students, and small businesses. Jetson devices act as portable AI processors that allow robots, industrial automation, and other hardware to run advanced AI computations locally without relying on remote data centers. With this move, Nvidia is looking to make AI development more accessible to those who are not its usual big-budget customers.

The $249 Jetson Orin Nano Super delivers nearly double the performance of its previous model, as it can handle about 70% more tasks while maintaining efficiency. It is also worth noting that it is designed for commercial developers working on devices like drones and smart cameras, whereas the higher-end version, Jetson Thor, is built for humanoid robots and complex automation.

Interestingly, despite U.S. restrictions on advanced hardware sales in China, Nvidia confirmed the Jetson products would still be available there through local distributors, ensuring a broader reach for its new offering.

Is NVDA a Good Stock to Buy?

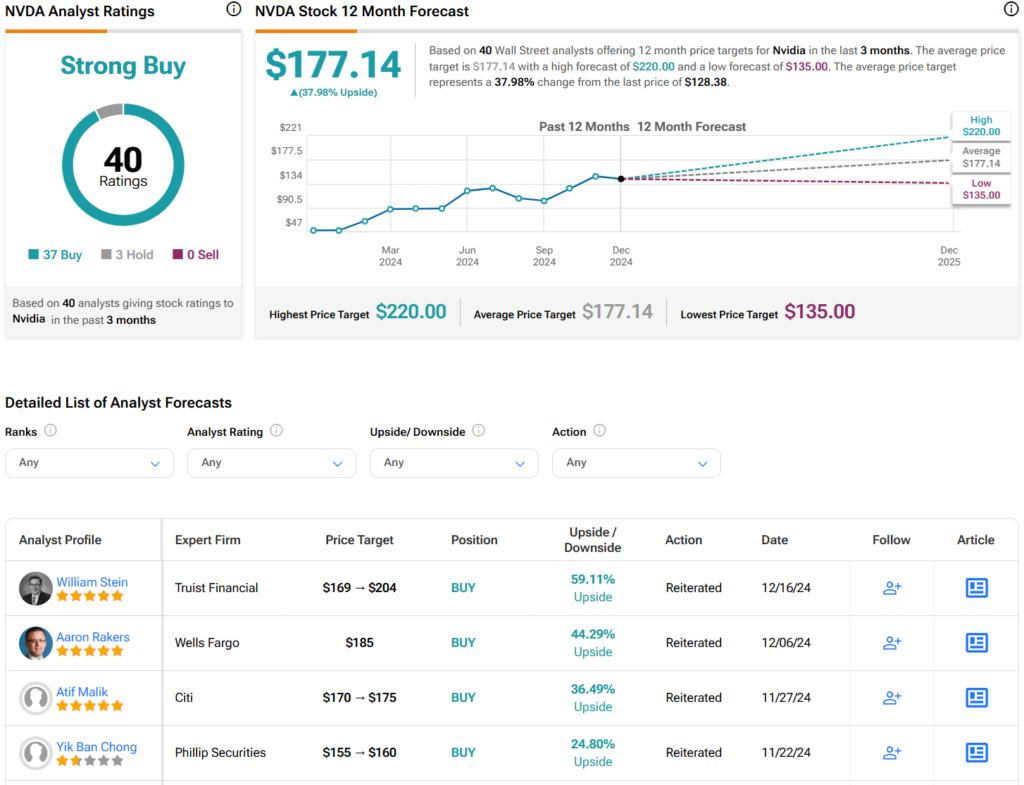

Overall, analysts remain bullish on NVDA stock, with a Strong Buy consensus rating based on 37 Buys and three Holds assigned in the past three months. After a 156% rally in its share price over the past year, the average NVDA price target of $177.14 per share implies an upside potential of 38% from current levels.